WARNING => Rothschild G20 Bloodsuckers: On November 16, 2014 Personal Bank Deposits To Be Classified Not As Your Savings But As Paper Investments In Corporate Banks. Get Into Your Local Credit Unions Now!

Additionally, all member nations of the G20 will immediately submit and pass legislation that will fulfill this program, creating a new paradigm where banks no longer recognize your deposits as money, but as liabilities and securitized capital owned and controlled by the bank or institution.

For most Americans with savings or checking accounts in federally insured banks, normal FDIC rules on deposit insurance are still in play, but anyone with over $250,000 in any one account, or held offshore, will have their money automatically subject to bankruptcy dispursements from the courts based on a much lower rank of priority, and a much lower percentage of return.

This also includes business accounts, money market accounts, and any depository investments such as a certificate of deposit (CD)…

After Sunday at the G20 meeting, the risks of holding any cash in a bank or financial institution will have to be weighed as heavily and with as much determination of risk as if you were holding a stock or municipal bond, which could decline in an instant should the financial environment bring a crisis even remotely similar to that of 2008.

From a technical perspective, this is moving in line with Murray Rothbard’s perspective on “bank deposit insurance,” which he saw as a scam:

1776 REVOLUTION

I suspect what is going on here is that the government is fully aware that this change will create a separation between bank deposits and government securities.

Government securities, especially short-term paper, will become a safer investment than large banks deposits. This will drive funds away from banks, private sector lending, and push funds into the direction of government sponsored debt (where there will be continued back up for such debt of the money printing presses).

Economic Policy Journal

Quark Cryptocurrency faster and far more secure brain child of Bitcoin engineers quietly awaits the collapse.

Thanks to: http://politicalvelcraft.org

Where-as People Do Not Need Money Changers!

On Nov. 16, the G20 will implement a new policy that makes bank deposits on par with paper investments, subjecting account holders to declines that one might experience from holding a stock or other security when the next financial banking crisis occurs.Additionally, all member nations of the G20 will immediately submit and pass legislation that will fulfill this program, creating a new paradigm where banks no longer recognize your deposits as money, but as liabilities and securitized capital owned and controlled by the bank or institution.

- Which Cities & States Will Be The First To Default When The Economy Rolls Over?

- Central Bankers & US Government Now Preparing For Dodd Frank Basel III Bail-Ins.

NO BAILOUTS ARREST THE CORRUPT BANKERS

Iceland Dismantles The Corrupt, Arrests 10 Rothschild Bankers, Then Issues Interpol Arrest Warrant For Rothschild Banker Sigurdur Einarsson!

In essence, the Cyprus template of 2011 will be fully implemented in every major economy, and place bank depositors as the primary instrument of the next bailouts when the next crisis occurs…- Rothschilds Attacks Russian Cyprus Holdings: Russia Launches Surprise Large-Scale, 36 Warship Military Exercise In The Black Sea

For most Americans with savings or checking accounts in federally insured banks, normal FDIC rules on deposit insurance are still in play, but anyone with over $250,000 in any one account, or held offshore, will have their money automatically subject to bankruptcy dispursements from the courts based on a much lower rank of priority, and a much lower percentage of return.

This also includes business accounts, money market accounts, and any depository investments such as a certificate of deposit (CD)…

After Sunday at the G20 meeting, the risks of holding any cash in a bank or financial institution will have to be weighed as heavily and with as much determination of risk as if you were holding a stock or municipal bond, which could decline in an instant should the financial environment bring a crisis even remotely similar to that of 2008.

From a technical perspective, this is moving in line with Murray Rothbard’s perspective on “bank deposit insurance,” which he saw as a scam:

[F]ractional reserve banking proved shaky, and so the New Deal, in 1933, added the lie of “bank deposit insurance,” using the benign word “insurance” to mask an arrant hoax.

When the savings and loan system went down the tubes in the late 1980s, the “deposit insurance” of the federal FSLIC [Federal Savings and Loan Insurance Corporation] was unmasked as sheer fraud.

The “insurance” was simply the smoke-and-mirrors term for the unbacked name of the federal government.

1776 REVOLUTION

Thus, the removal of protection for large depositors is eliminating the scam at this tier. It is, in other words, cutting down on moral hazard.The poor taxpayers finally bailed out the S&Ls, but now we are left with the formerly sainted FDIC [Federal Deposit Insurance Corporation], for commercial banks, which is now increasingly seen to be shaky, since the FDIC itself has less than one percent of the huge number of deposits it “insures.”

The very idea of “deposit insurance” is a swindle; how does one insure an institution (fractional reserve banking) that is inherently insolvent, and which will fall apart whenever the public finally understands the swindle?

Suppose that, tomorrow, the American public suddenly became aware of the banking swindle, and went to the banks tomorrow morning and in unison demanded cash. What would happen?

The banks would be instantly insolvent, since they could only muster 10 percent of the cash they owe their befuddled customers.

Neither would the enormous tax increase needed to bail everyone out be at all palatable.

No: the only thing the Fed could do and this would be in their power, would be to print enough money to pay off all the bank depositors.

Unfortunately, in the present state of the banking system, the result would be an immediate plunge into the horrors of hyperinflation.

I suspect what is going on here is that the government is fully aware that this change will create a separation between bank deposits and government securities.

Government securities, especially short-term paper, will become a safer investment than large banks deposits. This will drive funds away from banks, private sector lending, and push funds into the direction of government sponsored debt (where there will be continued back up for such debt of the money printing presses).

Economic Policy Journal

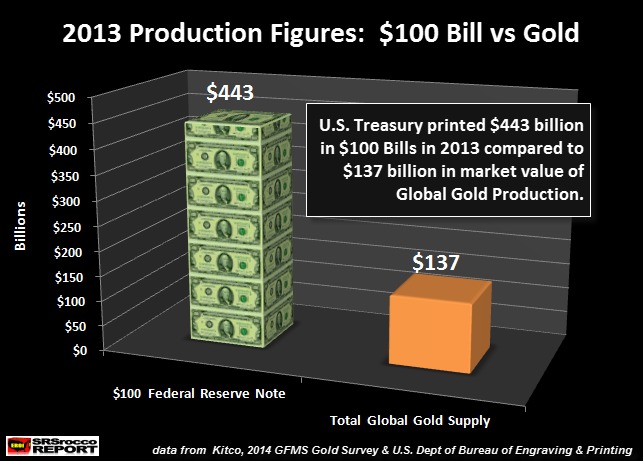

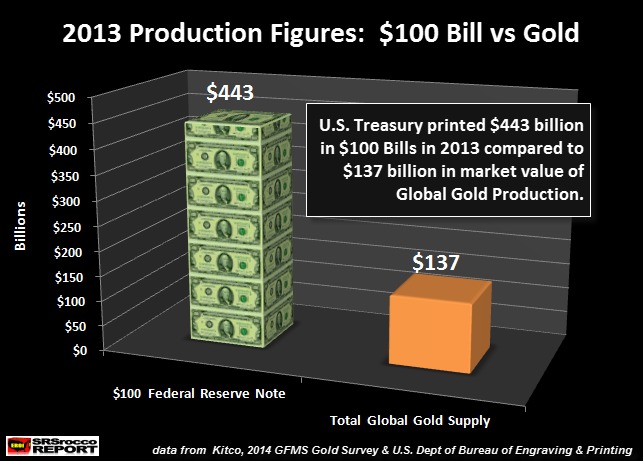

Rothschild’s Federal Reserve Printed Fiat Dollars 4Xs The Value Of The Global Gold Supply In 2013 Alone!

Quark Cryptocurrency faster and far more secure brain child of Bitcoin engineers quietly awaits the collapse.

Thanks to: http://politicalvelcraft.org

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo