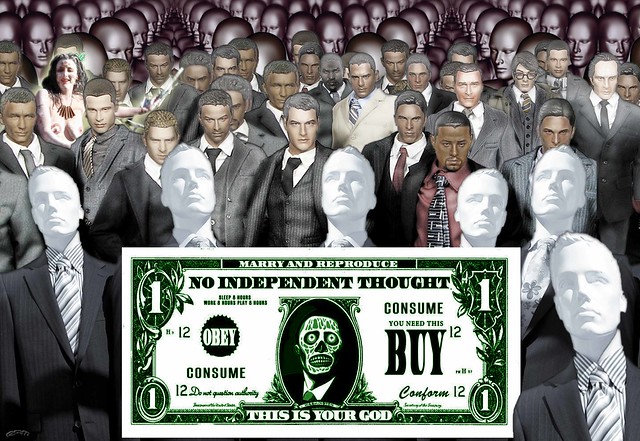

A Mad World Run By Funny Money

Why do We Allow Private Banks & Families to Control the World’s Money?

by Phillip J. Watt

The masses can no longer escape the knowledge that they’re being taken for a walk down a dark alley. The way money is created in our global society benefits the so-called elite at the expense of the 99.9%. It doesn’t have to be this way though, all we have to do is stand up and demand that it change.

Money is no longer backed by anything concrete. It used to be, when it was attached to the gold standard, but for the last several decades if you and I were to get a loan from a bank we’re not actually being loaned anything that they physically have. Instead, they punch numbers into a computer, which creates new money that is placed directly into our bank accounts.

That’s right – they create new cash out of nothing. They don’t get it from their vault, or borrow it from another source, they just create it on their computer. This begs the question: why do we allow private stakeholders, such as the banking families that control the world’s financial and political spheres, to profit from money that was created out of thin air? Can’t we just generate new funds for the benefit of the people and direct the profits back into the community?

Of course we can. If so, we could genuinely attempt to finally overcome poverty, homelessness and other socioeconomic disadvantage. In fact, there are some places on earth that have already taken the lead in transforming the way money is created and distributed in their society.

First of course is Iceland, who not only jailed 26 bankers for their fraudulent behavior that contributed to their economic meltdown during the GFC, but they are also initiating massive reforms to their banking sector. Additionally, they are going to give every citizen a share of the profit from the sale of one of their biggest banks.

It’s only the beginning, but well done Iceland, you’re killing it (the monetary-madness, that is).

Another example is North Dakota, who operates under a public-banking model. They have designed their state-owned bank in a way that was essentially immune to the 2008 GFC. It has also outperformed the private banking industry in terms of profitability. Many matrix-media explanations focus on excess deposits or the oil boom for its success, however that is simply not true. As explained in a Global Research article:

“To what, then, are the remarkable achievements of this lone public bank attributable? The answer is something the privately-owned major media have tried to sweep under the rug: the public banking model is simply more profitable and efficient than the private model. Profits, rather than being siphoned into offshore tax havens, are recycled back into the bank, the state and the community”.

When some people hear that a system like banking can be re-designed to actually benefit society, they automatically hear ‘socialism,’ and it offends them. The reality is, the celebration of the capitalist structure and the contempt towards socialism and communism achieves nothing. Just have a look at where capitalism has gotten us, regardless if it was taken over by crony capitalism and socialism for the rich.

The simple fact remains that going backwards is not an option, and right now humanity is being controlled by a monetary system that is, to put it bluntly, a joke. We need new approaches and innovative designs to move forward to build real peace and prosperity on planet earth, so as a collective we should make it a fundamental priority to seriously look at the available short and long term solutions that we could potentially implement, to once and for all put an end to being ruled by the banking oligarchy.

For examples of how to truly move forward read, [url=http://this article./]This is How to Create True Freedom for Humanity[/url].

If you want to contribute to the cause, sign and share the petition, here. And finally, watch this 5min video:

From Waking Times @ http://www.wakingtimes.com/2015/10/30/why-do-we-allow-private-banks-families-to-control-the-worlds-money/

If You Want to Limit the Power of the Super-Wealthy, Stop Using their Money

by Charles Hugh Smith

The only way to reverse rising inequality and break the power of the super-wealthy Financial Aristocracy is to stop using their central-bank issued currencies.

Many well-meaning people want to limit the wealth and power of the super-wealthy, i.e. the Financial Aristocracy/Oligarchy. (For more on the modern class structure, please see America's Nine Classes: The New Class Hierarchy.)

Reformers have suggested everything from a global tax on wealth (Piketty) to publicly owned banks to limiting the pay to play circus of campaign contributions.

None of these will change the power structure or limit the super-wealthy. as I explained last week, If We Don't Change the Way Money Is Created and Distributed, We Change Nothing. The super-wealthy will either move their capital elsewhere, derail the reforms, or have their political lackeys water the reforms down to the point they are nothing but a politically useful illusion of "change."

The only way to systemically limit the power and wealth of the Financial Aristocracy is to stop using their money, i.e. central-bank issued state currencies. Central-bank/state issued money is borrowed into existence and made available to financiers and the Financial Aristocracy to buy up productive assets.

Central states borrow some of this money to fund their bread and circuses welfare programs that keep the restive underclasses distracted, insecure and dependent on the state, but none of this actually changes the ownership or capital structure of the economy; it just makes the masses complicit in the status quo.

Though the vast majority of us have little opportunity to use money that isn't issued by central banks, that's changing. Bitcoin is the most well-known example of a non-state, non-central bank form of global money, but there are many more in use or in development.

The state/central bank monopoly on issuing and distributing money is (along with war-making and coercion) the state's most jealously guarded monopoly. The state-- which includes the largely invisible Deep State, the central bank (Federal Reserve) and the visible machinery of government--retains the sole right is issue money in whatever sums it chooses and to whom it chooses because the jig is up if the state loses the power to reward its Financial Aristocracy cronies and fund its own programs.

A nation-state in which the populace is free to use a variety of competing currencies is a nation-state in which the state can't fund itself with newly issued funny-money or distribute new money to the super-wealthy.

In a nation that uses competing global non-state currencies, the state must live off tax revenues and bonds sold in the open market, free of central bank collusion.

In a nation that uses competing global non-state currencies, the state cannot generate inflation by over-issuing money.

In a nation that uses competing global non-state currencies, the central bank loses the power to enrich the super-wealthy.

Isn't it obvious that whomever controls the digital "printing press" of new money controls everything? Conversely, if this power is stripped away from centralized states and their banks and decentralized (as I outline in my new book A Radically Beneficial World: Automation, Technology and Creating Jobs for All), the essential mechanism of transferring wealth to the super-wealthy and their political lapdogs (Clintons et al.) is broken.

States will naturally suppress competing currencies and outlaw any threat to their monopoly. That bitcoin is not yet illegal in the U.S. is a surprise. What isn't a surprise is that Goldman Sachs has sought patents on its own crypto-currency: Goldman Sachs wants to create its own version of bitcoin. (via Drew S.)

Those who believe states can never lose control of their currency should consider what happens in hyper-inflation. When states debauch their currencies and push them over the cliff, people abandon the currency in favor of money that holds its value and acts as a means of exchange.

In such a setting, a non-state digital crypto-currency currency is a practical solution. Gold and silver are always money, but they have their own risks and limitations ("my lead will take your gold" etc.). When official money loses its purchasing power, even phone-card minutes can act as money.

As farfetched as it may sound today, I suspect there will be a ruthlessly Darwinian sorting of currencies within the next 10 years. Nations with broken national currencies that adopt non-state competing currencies will outperform nations that cling to centralized enrich-the-already-super-wealthy model of central bank-issued currencies.

The only way to reverse rising inequality and break the power of the super-wealthy Financial Aristocracy is to stop using their central-bank issued national currencies. When the world ceases to use the Financial Aristocracy's money, their power to accumulate more wealth at the expense of everyone else will disappear.

Everyone who is convinced that the current status quo is permanent and unbreakable should consider what happened to the super-wealthy private landholders of the Western Roman Empire. When the empire's power to coerce broke down, the super-wealthy vanished into the dustbin of history.

Few believed that possible in 475 AD, but history isn't a matter of belief. Believing it isn't possible doesn't stop history.

Of related interest:

Is This How The Dollar Gets Replaced?

Why Bitcoin May Solve This Age-Old Economic Paradox

My new book is #5 in Amazon's Kindle ebooks > Business & Money > International Economics: A Radically Beneficial World: Automation, Technology and Creating Jobs for All. The Kindle edition is $8.45, a 15% discount from its list price of $9.95.

From Of Two Minds @ http://www.oftwominds.com/blogdec15/super-wealth12-15.html

Thanks to: http://nexusilluminati.blogspot.com

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo