Beyond the Stink of Capitalism

Creating a REAL Free World

The Post-Capitalist Society is Already Emerging in Denmark

by Alex Pietrowski

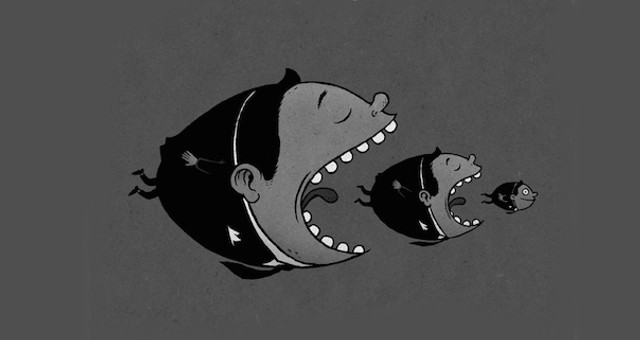

Similar to the end of feudalism hundreds of years ago, is capitalism to be replaced by a new type of social infrastructure and an emergence of a new kind of human being? Many believe that the much-needed shift has already started, as the message that capitalism is not working becomes louder and clearer. The system of monopolies, industrial giants, banks and governments has been so focused on privatization and commercialism that it has resulted in scarcity and inequality, lacking the vision of true freedom and abundance for all.

As the era of capitalism forges on, people are starting to realize the extent of its failures. Capitalism has been deficient in ensuring that basic human necessities are available to all, and has driven many people and even nations into financial ruin, enslaved by their jobs or by their creditors.

Feudalism was an economic system structured by customs and laws about “obligation”. Capitalism was structured by something purely economic: the market. We can predict, from this, that postcapitalism – whose precondition is abundance – will not simply be a modified form of a complex market society. But we can only begin to grasp at a positive vision of what it will be like.

~ Paul Mason, The Guardian

The shift into a new post-capitalism era is not likely to happen on a mass scale, but in a modular manner as different people, in different places, and at different speeds transform society, as in the example of Open Source Ecology, an organization that is helping to usher in a new type of collaborative global ‘maker’ culture.

Some would argue that the pre-era of post-capitalistic society already exists in some places, that it is already sculpting what will come next, while also diminishing the struggles of the “have-nots” and the artifice of the “haves”. Take Denmark for example. It is rated as one of the top 3 happiest countries in the world. When one starts to compare it to other countries, it appears that maybe they actually have society figured out. Here are some quick comparisons of Denmark to the United States (the US) and other countries in the Organisation for Economic Co-operation and Development (OECD), as compiled by We Are Anonymous:

1. Denmark’s per capita income is $6000 higher than in the US.

2. Denmark has the second lowest poverty rate out of the 34 countries in the OECD.

3. Denmark ranks seventh among OECD countries in terms of employment rate. And their unemployment benefits are admirable: if you’ve worked at least 52 weeks over a three-year period, you are entitled to 90% pay of your original salary for up to two years.

4. The work force enjoys an average work week of 33 hours per week and five weeks of paid vacation each year. To put things in perspective, the US average is 47 hours per week and you’d be lucky if you had more than 16 paid vacation days/holidays.

5. Healthcare spending is around $4400 per capita, above the OECD average of $3300, but dwarfed by the excessive $10000 per person in the US.

6. Tuition costs don’t exist! College is free and students are given a $900 per month stipend if they live on their own. Tuition costs from in-state public to private college in the US range from $9000 to $31000 per year.

7. Denmark was ranked by Forbes as the best country for business in 2014, and was ranked #3 by the World Bank for ease of doing business.

8. Parental leave after a birth of a child is an average of 52 weeks paid time off. In the US, an employer is required to give you no paid time off.

9. Although taxes are high in Denmark, Danes are still able to save. Total gross national saving is estimated at 24.1% of GDP in 2013 (in the US, it’s about 13%). This may have something to do with lower household consumption, which averages at 49% of GDP versus 69% in the US.

10. Denmark uses taxes and social spending aggressively to narrow the income gap between the rich and the rest.

“I know that some people in the US associate the Nordic model with some sort of socialism, therefore I would like to make one thing clear. Denmark is far from a socialist planned economy. Denmark is a market economy… The Nordic model is an expanded welfare state which provides a high level of security to its citizens, but it is also a successful market economy with much freedom to pursue your dreams and live your life as you wish.”

~ Danish Prime Minister Lars Lokke Rasmussen

Are you pursing your dreams and living your life as you wish? Could capitalism still get all of us there? Or is a new societal infrastructure imminent, just waiting for enough of us to wake up?

From Waking Times @ http://www.wakingtimes.com/2015/11/19/why-capitalism-doesnt-work-and-one-countrys-vision-of-a-better-society/

[size=37]To Lift Quality of Life and Economy, Finland Champions Universal Basic Income[/size]

Under the plan receiving support by 70 percent of the country, every adult would receive a monthly allotment of €800

Finland is planning to provide 800 euros per month to all citizens as a new form of benefit called national basic income. The Finnish government is planning to present the plan by November 2016. (Photo: Flickr/ Euro Note Currency)

by Jon Queally

As a way to improve living standards and boosts its economy, the nation of Finland is moving closer towards offering all of its adult citizens a basic permanent income of approximately 800 euros per month.

"Basic income would increase everybody’s capacity to cope with financial shocks and uncertainties and would improve general quality of life, while supporting many different kinds of work, with or without pay."

—Anne B. Ryan, Enough Is Plenty

The monthly allotment would replace other existing social benefits, but is an idea long advocated for by progressive-minded social scientists and economists as a solution—counter-intuitive as it may first appear at first—that actually decreases government expenditures and unemployment while boosting both productivity and quality of life.

"For me, a basic income means simplifying the social security system," Finland's Prime Minister Juha Sipilä said last week.

Though it would not be implemented until later in 2016, recent polling shows that nearly 70 percent of the Finnish people support the idea.

According to Bloomberg, the basic income proposal, put forth by the Finnish Social Insurance Institution, known as KELA, would see every adult citizen "receive 800 euros ($876) a month, tax free, that would replace existing benefits. Full implementation would be preceded by a pilot stage, during which the basic income payout would be 550 euros and some benefits would remain."

As reporting by the UK-based Metro notes:

While it may seem like a standard basic income would encourage people not to work, it’s actually designed to do the opposite.

Under the current welfare system, a person gets less in benefits if they take up temporary, low paying or part-time work – which can result in an overall loss of income.

However, a basic rate of pay would allow people to take up these jobs with no personal cost.

And the idea, according to Irish writer and researcher Anne B. Ryan, author of the book Enough Is Plenty, is one that deserves much more serious attention and consideration that it currently receives. In this primer on the idea, Ryan explains the essential features and positive benefits of a universal basic income:

Basic income is a regular and unconditional distribution of money by the state to every member of society, whether they engage in paid work or not. Basic income is always tax-free and it replaces social welfare payments, child benefit and the state pension as we currently know them. It also extends to all those who currently receive no income from the state. Ideally, a basic income would be sufficient for each person to have a frugal but decent lifestyle without supplementary income from paid work.

Basic income would bring into the security net all those not served by the current system: casual and short-contract workers who get no or limited sick pay, holiday pay or pension rights; self-employed people and business owners; those doing valuable unpaid work, including care, which adds value to society and economy. Basic income would increase everybody’s capacity to cope with financial shocks and uncertainties and would improve general quality of life, while supporting many different kinds of work, with or without pay.

Currently, those receiving welfare are badly served by the system: if they take paid work, especially low-paid or temporary, they often lose out financially, in a ‘benefits trap’. With basic income, there would always be a financial incentive for people to earn a taxable income, should a job be available. Employers would also welcome the ending of the benefits trap.

As Quartz reports, previous experiments with a basic income have shown promising results:

Everyone in the Canadian town of Dauphin was given a stipend from 1974 to 1979, and [url=http://public.econ.duke.edu/~erw/197/forget-cea %282%29.pdf]though there was a drop in working hours[/url], this was mainly because men spent more time in school and women took longer maternity leaves. Meanwhile, when thousands of unemployed people in Uganda were given unsupervised grants of twice their monthly income, working hours increased by 17% and earnings increased by 38%.

According to Ryan, advocates of the basic income model will likely be well-served by additional and larger experiments with its implementation. "Basic income is not a panacea; it will not solve all our social, ecological or debt problems, nor does it claim to," she wrote. "But it creates the conditions for creative solutions, rather than blocking them, as much of our present social security system does."

From Common Dreams @ http://www.commondreams.org/news/2015/12/06/lift-quality-life-and-economy-finland-champions-universal-basic-income

Dutch city plans to pay all citizens a ‘basic income’, and Greens say it could work in the UK

Utrecht takes step towards paying people a salary whether they work or not

The cafes and restaurants alongside the Oudegracht (Old Canal) in central Utrecht. Photograph: Alamy

by Daniel Boffey

It’s an idea whose adherents over the centuries have ranged from socialists to libertarians to far-right mavericks. It was first proposed by Thomas Paine in his 1797 pamphlet, Agrarian Justice, as a system in which at the “age of majority” everyone would receive an equal capital grant, a “basic income” handed over by the state to each and all, no questions asked, to do with what they wanted.

It might be thought that, in these austere times, no idea could be more politically toxic: literally, a policy of the state handing over something for nothing. But in Utrecht, one of the largest cities in the Netherlands, and 19 other Dutch municipalities, a tentative step towards realising the dream of many a marginal and disappointed political theorist is being made.

The politicians, well aware of a possible backlash, are rather shy of admitting it. “We had to delete mention of basic income from all the documents to get the policy signed off by the council,” confided Lisa Westerveld, a Green councillor for the city of Nijmegen, near the Dutch-German border.

“We don’t call it a basic income in Utrecht because people have an idea about it – that it is just free money and people will sit at home and watch TV,” said Heleen de Boer, a Green councillor in that city, which is half an hour south of Amsterdam.

Nevertheless, the municipalities are, in the words of de Boer, taking a “small step” towards a basic income for all by allowing small groups of benefit claimants to be paid £660 a month – and keep any earnings they make from work on top of that. Their monthly pay will not be means-tested. They will instead have the security of that cash every month, and the option to decide whether they want to add to that by finding work. The outcomes will be analysed by eminent economist Loek Groot, a professor at the University of Utrecht.

A start date for the scheme has yet to be settled – and only benefit claimants involved in the pilots will receive the cash – but there is no doubting the radical intent. The motivation behind the experiment in Utrecht, according to Nienke Horst, a senior policy adviser to the municipality’s Liberal Democrat leadership, is for claimants to avoid the “poverty trap” – the fact that if they earn, they will lose benefits, and potentially be worse off.

The idea also hopes to target “revolving door clients” – those who are forced into jobs by the system but repeatedly walk out of them. If given a basic income, the thinking goes, these people might find the time and space to look for long-term employment that suits them.

But the logic of basic income, according to people to the left of Horst, leads only one way – to the cash sum becoming a universal right. It would be unthinkable for those on benefits to be earning and receiving more than their counterparts off benefits. Horst admitted: “Some municipalities are very into the basic income thing.”

Indeed leftwing councillors in Utrecht believe this is an opportunity to prove to a sceptical public that people don’t just shirk and watch television if they are given a leg-up. “I think we need to have trust in people,” said de Boer.

Caroline Lucas, the Green party’s only MP in the House of Commons, agrees. A basic income – the Greens call it a “citizen’s wage” – has long been party policy. It did not make the cut for their manifesto because they couldn’t find a way to fund it.

But developments in the Netherlands, and a parallel pilot in Finland, have bolstered Lucas’s belief that this idea’s time has come. The Royal Society of Arts has been examining the feasibility of the idea, as has campaign group Compass.

To those who say it is an unaffordable pipedream, Westerveld points out the huge costs that come with the increasinglytough benefits regimes being set up by western states, including policies that make people do community service to justify their handouts. “In Nijmegen we get £88m to give to people on welfare,” Westerveld said, “but it costs £15m a year for the civil servants running the bureaucracy of the current system. We will save money with a ‘basic income’.”

Horst adds: “If you receive benefits from the government [in Holland] now you have to do something in return. But most municipalities don’t have the people to manage that. We have 10,000 unemployed people in Utrecht, but if they all have to do something in return for welfare we just don’t have the people to see to that. It costs too much.”

Lucas says she will seek a parliamentary debate on the policy in the new year, and will ask the government to look into the feasibility of a “basic income” pilot here. “I think in Britain people have quite a puritanical idea of work,” she said. “But this is an urgently needed policy. With increased job insecurity, the idea of everyone working nine to five is outdated. People go in and out of work these days.” “People are increasingly working in what they call the gig economy. The current system is not fit for purpose.”

The idea faces a tough political headwind, of course, not least in the Netherlands. Last Tuesday, Johanna von Schaik-Vijfschaft, 41, could be found updating her CV on one of the computers made available to benefits claimants at the Utrecht council building. A cleaner at a local department store, she had been told by council officials to find more work than the 12 hours she currently does.

But she will be under even more pressure in a few years when her 19-year-old son turns 21 and leaves her care. Once she has no dependants, she will lose £150 of her £500 monthly benefit payment and come under the remit of the participation laws, legislation recently brought in by the rightwing central government to make benefits claimants work harder for their cash. Von Schaik-Vijfschaft could be ordered to do some community work for the council in return for her benefits, and will face the threat of losing more of her income if her application rate for jobs falls away. And if Von Schaik-Vijfschaft were to dress inappropriately for interviews or, worse still, miss an appointment, she will lose all her benefits for a month.

The country’s second city, Rotterdam, has even trialled a “work first” system, where aspiring benefits claimants must put on an orange jacket and spend two months clearing rubbish before they are handed any payments.

“Rules, always the rules,” von Schaik-Vijfschaft said. “But of course I want to work. I want to be busy – we all do.” If the experiment can prove that, maybe Tom Paine’s idea will have its day yet.

HOW IT WORKS

■ A “basic income”, first proposed by Thomas Paine is an income unconditionally granted to all on an individual basis, without any means test or requirement to work.

■ It is paid irrespective of any income from other sources.

■ It is paid without requiring the performance of any work or the willingness to accept a job.

■ Advocates say it will allow people to genuinely choose what sort of employment they take, and to retrain when they wish.

■ Its proponents also claim that a basic income scheme is one of the most simple benefits models, and will reduce all the bureaucracy surrounding the welfare state, making it less complex and much cheaper to administer.

From The Guardian @ http://www.theguardian.com/world/2015/dec/26/dutch-city-utrecht-basic-income-uk-greens

Helicopter Money Arrives: Switzerland to Hand Out $2500 Monthly to All Citizens

by Tyler Durden

by Tyler Durden With Citi's chief economist proclaiming "only helicopter money can save the world now," and the Bank of England pre-empting paradropping money concerns, it appears that Australia's largest investment bank's forecast that money-drops were 12-18 months away was too conservative. While The Finns consider a "basic monthly income" for the entire population, Swiss residents are to vote on a countrywide referendum about a radical plan to pay every single adult a guaranteed income of around $2500 per month, with authorities insisting that people will still want to find a job.

The plan, as The Daily Mail reports, proposed by a group of intellectuals, could make the country the first in the world to pay all of its citizens a monthly basic income regardless if they work or not. But the initiative has not gained much traction among politicians from left and right despite the fact that a referendum on it was approved by the federal government for the ballot box on June 5.

Under the proposed initiative, each adult would receive $2,500 per months, and each child would also receive 625 francs ($750) a month.

The federal government estimates the cost of the proposal at 208 billion francs ($215 billion) a year.

Around 153 billion francs ($155 bn) would have to be levied from taxes, while 55 billion francs ($60 bn) would be transferred from social insurance and social assistance spending.

That is 30% of GDP!!!

The action committee pushing the initiative consists of artists, writers and intellectuals, including publicist Daniel Straub, former federal government spokesman Oswald Sigg and Zurich rapper Franziska Schläpfer (known as “Big Zis”), the SDA news agency reported. Personalities supporting the bid include writers Adolf Muschg and Ruth Schweikert, philosopher Hans Saner and communications expert Beatrice Tschanz. The group said a new survey showed that the majority of Swiss residents would continue working if the guaranteed income proposal was approved.

'The argument of opponents that a guaranteed income would reduce the incentive of people to work is therefore largely contradicted,' it said in a statement quoted by The Local.

However, a third of the 1,076 people interviewed for the survey by the Demoscope Institute believed that 'others would stop working'.

And more than half of those surveyed (56 percent) believe the guaranteed income proposal will never see the light of day.

The initiative’s backers say it aims to break the link between employment and income, with people entitled to guaranteed income regardless of whether they work.

Or put another way - break the link between actually having to work for anything ever again... but maybe this "group of itellentuals" should hark Margaret Thatcher's words that "eventually you run out of other people's money!!"

* * *

As we previously detailed, support is growing around the world for such spending to be funded by “People’s QE.” The idea behind “People’s QE” is that central banks would directly fund government spending… and even inject money directly into household bank accounts, if need be. And the idea is catching on.

Already the European Central Bank is buying bonds of the European Investment Bank, an E.U. institution that finances infrastructure projects. And the new leader of Britain’s Labor Party, Jeremy Corbyn, is backing a British version of this scheme.

That’s the monster coming to towns and villages near you! Call it “overt monetary financing.” Call it “money from helicopters.” Call it “insane.”

But it won’t be unpopular. Who will protest when the feds begin handing our money to “mid- and low-income households”?

Simply put, The Keynesian Endgame is here... as the only way to avoid secular stagnation (which, for the uninitiated, is just another complicated-sounding, economist buzzword for the more colloquial “everything grinds to a halt”) is for central bankers to call in the Krugman Kraken and go full-Keynes.

Rather than buying assets, central banks drop money on the street. Or even better, in a more modern and civilised fashion, credit our bank accounts! That, after all, may be more effective than buying assets, and would not imply the same transfer of wealth as previous or current forms of QE. Indeed, ‘helicopter money’ can be seen as permanent QE, where the central bank commits to making the increase in the monetary base permanent.

Again, crediting accounts does not guarantee that money will be spent – in contrast to monetary financing where the newly created cash can be used for fiscal spending. And in many cases, such policy would actually imply fiscal policy, as most central banks cannot conduct helicopter money operations on their own.

So again, the thing to realize here is that this has moved well beyond the theoretical and it's not entirely clear that most people understand how completely absurd this has become (and this isn't necessarily a specific critique of SocGen by the way, it's just an honest look at what's going on). At the risk of violating every semblance of capital market analysis decorum, allow us to just say that this is pure, unadulterated insanity. There's not even any humor in it anymore.

You cannot simply print a piece of paper, sell it to yourself, and then use the virtual pieces of paper you just printed to buy your piece of paper to stimulate the economy. There's no credibility in that whatsoever, and we don't mean that in the somewhat academic language that everyone is now employing on the way to criticizing the Fed, the ECB, and the BoJ.

And it will end only one way...

The monetizing of state debt by the central bank is the engine of helicopter money. When the central state issues $1 trillion in bonds and drops the money into household bank accounts, the central bank buys the new bonds and promptly buries them in the bank's balance sheet as an asset.

The Japanese model is to lower interest rates to the point that the cost of issuing new sovereign debt is reduced to near-zero. Until, of course, the sovereign debt piles up into a mountain so vast that servicing the interest absorbs 40+% of all tax revenues.

But the downsides of helicopter money are never mentioned, of course. Like QE (i.e. monetary stimulus), fiscal stimulus (helicopter money) will be sold as a temporary measure that quickly become permanent, as the economy will crater the moment it is withdrawn.

The temporary relief turns out to be, well, heroin, and the Cold Turkey withdrawal, full-blown depression.

From Zero Hedge @ http://www.zerohedge.com/news/2016-01-29/helicopter-money-arrives-switzerland-hand-out-2500-monthly-all-citizens

Thanks to: http://nexusilluminati.blogspot.com

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo