China Unshackles From Bitcoin: Beijing To Shut Down All Crypto Exchanges By The End Of September

14 Sep 2017 by Volubrjotr

14 Sep 2017 by Volubrjotr

USD attempts a new face & name as SDR

USD attempts a new face & name as SDR

SDR Is Bitcoin’s Fiat Cousin

SDR Is Bitcoin’s Fiat Cousin

Yuan-denominated Bitcoin has crashed as much as 25% 35% in Chinese trading, plunging from 25,000 yuan to as a low of 16,000 on local exchanges BTCChina (and as low as 20,000 on OKCoin), following confirmation of last week’s Caixin report that Beijing would stop cryptocurrency exchange trading.

China’s second largest exchange, BTC China, said that it would halt all trading on the platform beginning September 30, launching a liquidation panic.

In a statement released on Weibo, BTC China said that it would immediately stops accepting new account registrations on BTCChina Exchange. The decision was made after “carefully considering” Chinese regulatory bodies’ Sept. 4 announcement on preventing risks associated with token fundraising. A google-translated version of the statement:

China will stop all trading business on September 30th

https://youtu.be/4rmobXfLzo4

Dear Bitcoal Chinese users: According to the September 4 issue of the “People’s Bank of China Central Office of the Ministry of Industry and Information Technology Ministry of Industry and Commerce, China Banking Regulatory Commission, China Securities Regulatory Commission on the prevention and treatment of the risk of the issuance of the currency,” the spirit of the document, adhering to the protection of investment risks, the maximum protection of users

The principle of interest, Bit Coin Chinese team by careful discussion, is to make the following decision:

1. Bit currency China’s digital asset trading platform today to stop the registration of new users;

2. September 30, 2017 Digital asset trading platform will stop all trading business.

Beitou China’s pool (pool) and other business will not be affected, continue to normal operation.

We apologize for the inconvenience. If you have any questions, please contact support@btcchina.com.

While China no longer dominates cryptocurrency trading – it accounted for nearly 90% of all trading in late 2016 before Beijing launched a series of measures to limit participaton – and is now responsible for less than 40% of global volumes, the Chinese selloff has spooked global markets, pushing bitcoin sharply lower on international exchanges as well like Coinbase, where it was trading at approximately $3,600 last.

This isn’t the first time the bitcoin market in China has come under regulatory scrutiny. In early February, major exchanges suspended withdrawals of bitcoin and stepped up their scrutiny of clients after meeting with the central bank.

Emil Chan, vice-president of the Hong Kong Blockchain Society, said it would be difficult for regulators to outlaw bitcoin trading altogether. “There is no option to restrict cross-border sales of bitcoin. It is a smarter move to maintain the operation of the local exchanges if the central bank’s goal is to minimise the outflow of yuan.”

https://youtu.be/HmPeBEOTS4A

Still, the virtual currency is up more than six times from a year ago, with some participants convinced the bitcoin market is in a bubble. “In fact, the market was too hot. The action taken is an effective action to cool down the global cryptocurrency market,” said Chan.

Meanwhile, Leonhard Weese, president of the Bitcoin Association of Hong Kong, said if China continues to toughen up on regulations to restrict growth in bitcoin, it may drive the business to the city.

“People in China will be more careful about marketing these events, and a lot of that marketing activity will come to Hong Kong in the form of conferences and communities,” said Weese.

It remains to be seen if Chinese bitcoin fans will simply switch to other OTC/bilateral forms of trading, or simply take their trading to neighboring Japan and South Korea which remain eager advocates of trading in the crypto space.

ZeroHedge

Thanks to: https://politicalvelcraft.org

14 Sep 2017 by Volubrjotr

14 Sep 2017 by Volubrjotr  USD attempts a new face & name as SDR

USD attempts a new face & name as SDR  SDR Is Bitcoin’s Fiat Cousin

SDR Is Bitcoin’s Fiat Cousin Yuan-denominated Bitcoin has crashed as much as 25% 35% in Chinese trading, plunging from 25,000 yuan to as a low of 16,000 on local exchanges BTCChina (and as low as 20,000 on OKCoin), following confirmation of last week’s Caixin report that Beijing would stop cryptocurrency exchange trading.

China’s second largest exchange, BTC China, said that it would halt all trading on the platform beginning September 30, launching a liquidation panic.

- SDR to Bitcoin

- More Countries Separate Themselves From U.S. Deep State IMF’s SDR, aka; PetroDollar

In a statement released on Weibo, BTC China said that it would immediately stops accepting new account registrations on BTCChina Exchange. The decision was made after “carefully considering” Chinese regulatory bodies’ Sept. 4 announcement on preventing risks associated with token fundraising. A google-translated version of the statement:

China will stop all trading business on September 30th

https://youtu.be/4rmobXfLzo4

Dear Bitcoal Chinese users: According to the September 4 issue of the “People’s Bank of China Central Office of the Ministry of Industry and Information Technology Ministry of Industry and Commerce, China Banking Regulatory Commission, China Securities Regulatory Commission on the prevention and treatment of the risk of the issuance of the currency,” the spirit of the document, adhering to the protection of investment risks, the maximum protection of users

The principle of interest, Bit Coin Chinese team by careful discussion, is to make the following decision:

1. Bit currency China’s digital asset trading platform today to stop the registration of new users;

2. September 30, 2017 Digital asset trading platform will stop all trading business.

Beitou China’s pool (pool) and other business will not be affected, continue to normal operation.

We apologize for the inconvenience. If you have any questions, please contact support@btcchina.com.

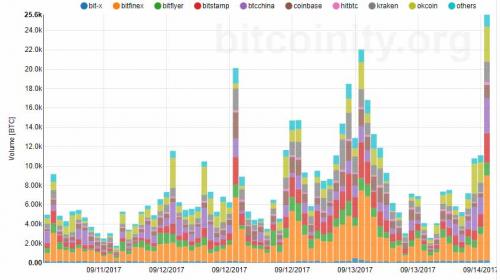

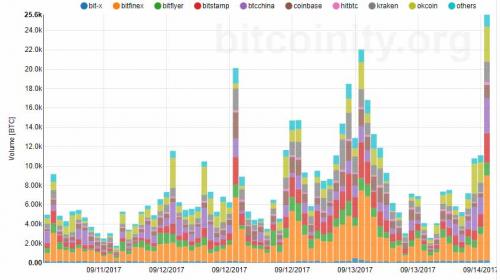

The immediate result was a sharp plunge in the CNY-denominated price of bitcoin on exchanges like BTC China and OKCoin:

While China no longer dominates cryptocurrency trading – it accounted for nearly 90% of all trading in late 2016 before Beijing launched a series of measures to limit participaton – and is now responsible for less than 40% of global volumes, the Chinese selloff has spooked global markets, pushing bitcoin sharply lower on international exchanges as well like Coinbase, where it was trading at approximately $3,600 last.

A breakdown of global bitcoin exchanges by volume is shown below:

- Chart Is Telling Us That The $USD Is Going To Be Collapsing In The Coming Months.

- China Escalates Crackdown On Corrupt Banking: 370 People Arrested In Illegal Foreign-Exchanges Totaling $64 Billion.

Also notable: as of this moment, China-denominated bitcoin is trading at about 17,000 yuan or just under US$2,500, indicating there is a nearly 30% arb between Chinese and offshore trading.

- China to outlaw Bitcoin exchanges fully by end of September

This isn’t the first time the bitcoin market in China has come under regulatory scrutiny. In early February, major exchanges suspended withdrawals of bitcoin and stepped up their scrutiny of clients after meeting with the central bank.

Emil Chan, vice-president of the Hong Kong Blockchain Society, said it would be difficult for regulators to outlaw bitcoin trading altogether. “There is no option to restrict cross-border sales of bitcoin. It is a smarter move to maintain the operation of the local exchanges if the central bank’s goal is to minimise the outflow of yuan.”

https://youtu.be/HmPeBEOTS4A

Still, the virtual currency is up more than six times from a year ago, with some participants convinced the bitcoin market is in a bubble. “In fact, the market was too hot. The action taken is an effective action to cool down the global cryptocurrency market,” said Chan.

Meanwhile, Leonhard Weese, president of the Bitcoin Association of Hong Kong, said if China continues to toughen up on regulations to restrict growth in bitcoin, it may drive the business to the city.

“People in China will be more careful about marketing these events, and a lot of that marketing activity will come to Hong Kong in the form of conferences and communities,” said Weese.

It remains to be seen if Chinese bitcoin fans will simply switch to other OTC/bilateral forms of trading, or simply take their trading to neighboring Japan and South Korea which remain eager advocates of trading in the crypto space.

ZeroHedge

Thanks to: https://politicalvelcraft.org

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo