Informed Investor Advisory: CryptocurrenciesAre you an informed investor?

Be Cautious of the Crypto Investment Craze

Cryptocurrencies burst into the investing mainstream in 2017 as the values of some virtual coins and tokens skyrocketed, led by Bitcoin. Mainstream media now feature daily coverage of new cryptocurrencies, coin exchanges, and related investment products. Stories of “crypto millionaires” have attracted some investors to try their hand at investing in cryptocurrencies or crypto-related investments. But stories of those who bet big and lost are now starting to appear.Before you jump into the crypto craze, be mindful that cryptocurrencies and related financial products may be nothing more than public facing fronts for Ponzi schemes and other frauds. And because these products do not fall neatly into the existing federal/state regulatory framework, it may be easier for the promoters of these products to fleece you. Investing in cryptocurrencies and related financial products accordingly should be seen for what it is: extremely risky speculation with a high risk of loss.

What is a Cryptocurrency?

Cryptocurrencies are digital assets created by companies or individuals that take the form of a virtual coin or token. Anyone can create a cryptocurrency. Cryptocurrencies are intangible and exist only on the internet. Central banks and other governmental authorities do not insure or control cryptocurrencies. You cannot always exchange them for other fiat currencies (i.e., currencies declared “legal tender” by governments), such as the U.S. or Canadian dollar or Mexican peso.

Cryptocurrencies trade on unregulated, opaque exchanges on which there may be little or no opportunity to independently verify their true market value. And given the newness and uniqueness of cryptocurrencies and related instruments, they do not yet have a clear place in the existing framework of financial regulation.

Federal and state regulators are actively working to combat cryptocurrency-related frauds and to develop legislative or rule changes that will establish a more appropriate regulatory framework for cryptocurrencies. Investors should be aware that, at least for now, cryptocurrencies and related instruments trade without the investor protections that regulation provides.

Crypto-Investment Products

Investors looking to get in on what some people consider a modern-day gold rush are finding new investment options opening up to them all the time. Many of these solicitations are marketed aggressively through social media. For example, there are initial coin offerings (ICOs) or initial token offerings (ITOs). When an issuer makes an ICO or ITO, it sells “coins” or “tokens” in order to fund a proposed project. These coins or tokens are not the same as common stock or other securities.

While these offerings may sound like an initial public offering (IPO), they could not be more different. IPOs operate in a highly regulated environment. While securities or commodities regulations apply to ICOs and ITOs, many are unregistered and operate outside of these investor protection regulatory requirements.

Investors also are being pitched crypto-investment funds that pool investors’ assets in order to give them exposure to cryptocurrencies and ICOs or ITOs. Even some public companies are trying to cash in on the crypto-craze by changing their business models and names to attract capital.

Common Schemes

Fraudsters exploit trends by creating schemes that capitalize on new or popular investment products. This is the case with cryptocurrencies and crypto-investments. Here are a few crypto-related schemes:

Fake digital wallets: A digital wallet is used to store, send and receive cryptocurrencies. Scammers design a fake digital wallet to lure users into providing their private key or code that enables the wallet to open. Once a scammer receives the private key, he or she can steal all the cryptocurrency from the owner’s digital wallet.

Pump-and-dumps: Groups of individuals coordinate to buy a thinly-traded cryptocurrency, promote the cryptocurrency on social media to push up demand and the price, and then sell it in a coordinated sale. The price plummets and those unaware of the scheme are left with the devalued cryptocurrency.

Multi-level marketing platforms: Companies lure investors through the promise of high interest with low risk. These

investors are then incentivized to recruit more members.

For example: A company creates a new token or coin and sells it to investors in exchange for a cryptocurrency with a higher perceived value, such as Bitcoin. The company claims to have some method, often portrayed as “secret” or “proprietary,” that pays investors unusually high daily “interest” on its coin. The company promises commissions to promoters who recruit new investors. The promoters rely heavily on social media platforms (including Reddit, YouTube, Facebook, Twitter and Instagram) to hype the schemes and attract new investors, often using the promise of too-good-to-be-true investment returns (for example, 1 percent daily returns). Eventually the company stops paying “interest” and shuts down the program, keeping the invested cryptocurrency and leaving investors with worthless tokens or coins.

Common Concerns

Here are some common concerns investors should consider before investing in any offering containing cryptocurrency:

Volatility: Cryptocurrency markets are highly volatile, making them unsuitable for most investors looking to meet long-term savings or retirement goals.

No recourse: Cryptocurrency and many crypto-related investments are subject to minimal regulatory oversight, and there may be no recourse should the cryptocurrency disappear due to a cybersecurity breach or hack.

Untraceable: Cryptocurrency or crypto-related investments only exist on the internet. Issuers can be located anywhere in the world, so it may be impossible to trace and recover lost funds through the courts.

Uninsured: Cryptocurrency accounts are not insured by U.S. or Canadian depository insurance.

Unregulated: Cryptocurrency investors rely upon unregulated exchanges that may lack appropriate internal controls, making them susceptible to fraud, theft and hacking.

Hackable: Creating a digital wallet to store cryptocurrency involves installing software on an investor’s computer. As with any software download, hackers may include malicious code.

Vulnerable: Purchasers of cryptocurrencies rely on the strength of their own computer systems as well as systems provided by third parties to protect purchased cryptocurrencies from theft.

The Bottom Line

As with any new type of product, fraudsters are willing and ready to exploit the hype around cryptocurrencies and related products for their own purposes. Cryptocurrencies and related products are not functional equivalents of traditional banking, securities or insurance investment products.

If you choose to invest in a cryptocurrency or related product, be prepared to lose the entire amount of your investment. Before making any financial decisions, do your homework and contact your state or provincial securities regulator. Contact information is available on NASAA’s website, here.

Other Resources

North American Securities Administrators Association (NASAA)

- NASAA Reminds Investors to Approach Cryptocurrencies, Initial Coin Offerings and Other Cryptocurrency-Related Investment Products with Caution (Jan. 4, 2018)

US Securities and Exchange Commission (SEC)

- Statement on Cryptocurrencies and Initial Coin Offerings (December 11, 2017)

Commodity Futures Trading Commission (CFTC)

- A CFTC Primer on Virtual Currencies (Oct. 17, 2017)

- Customer Advisory: Understand the Risks of Virtual Currency Trading (Jan. 2018)

Canadian Securities Administrators (CSA)

- Staff Notice 46-307 Cryptocurrency Offerings (Aug. 24, 2017)

Financial Industry Regulatory Authority (FINRA)

- Don’t Fall for Cryptocurrency-Related Stock Scams (Dec. 21, 2017)

State Securities Regulators Take Action

Examples of Recent Enforcement Actions by NASAA MembersCalifornia

- In the Matter of USFIA, Inc., et al. ([url=http://www.dbo.ca.gov/Press/press_releases/2015/USFIA Desist and Refrain Order Signed 10-01-15.pdf]Order[/url]) (10-01-2015)

Massachusetts

- In the Matter of Caviar & Kirill Bensonoff (Docket No. E-2017-0120) (01-17-2018)

New Jersey

- In the Matter of Bitstrade (Order) (02-09-2018)

North Carolina

- In the Matter of BitConnect, et al. (Order No. 17 SEC 091) (01-09-2018)

South Carolina

- In the Matter of Swiss Gold Global, Inc. and Genesis Mining, Ltd. (Order No. 17021) (03-09-2018)

Texas

- In the Matter of USI-Tech ([url=https://www.ssb.texas.gov/sites/default/files/USI-Tech ENF-17-CDO-1753.pdf]Order No. ENF-17-CDO-1753)[/url] (12-20-2017)

- In the Matter of BitConnect (Order No. ENF-18-CDO-1754) (01-04-2108)

- In the Matter of R2BCoin (Order No. ENF-18-CDO-1756) (01-24-2018)

- In the Matter of DavorCoin (Order No. ENF-18-CDO-1757) (02-02-2018)

- In the Matter of Investors in Crypto LLC (Order No. ENF-18-CDO-1759) (02-15-2018)

- In the Matter of LeadInvest (Order No. ENF-18-CDO-1760) (March 5, 2018)

http://www.nasaa.org/44848/informed-investor-advisory-cryptocurrencies/  Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 12:40 pm

Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 12:40 pm Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 1:19 pm

Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 1:19 pm

Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 3:33 pm

Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 3:33 pm Meta1 coin ordering form- looks legit eh? Thu Dec 27, 2018 4:39 pm

Meta1 coin ordering form- looks legit eh? Thu Dec 27, 2018 4:39 pm CHECKS

CHECKS META COIN RECEIVING WALLETS

META COIN RECEIVING WALLETS BCH qqra6mty3nmc8s5z8lq6jqcsgygyl6xx95nzu3xwc6

BCH qqra6mty3nmc8s5z8lq6jqcsgygyl6xx95nzu3xwc6 Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 6:08 pm

Re: Dave Schmidt new scam - Meta1 Coin Thu Dec 27, 2018 6:08 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:35 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:35 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:37 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:37 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:42 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:42 am Inside Dave "the Douchebag" Schmidt's Meta 1 Scam - "The Defunct Exchange" 12/27/18

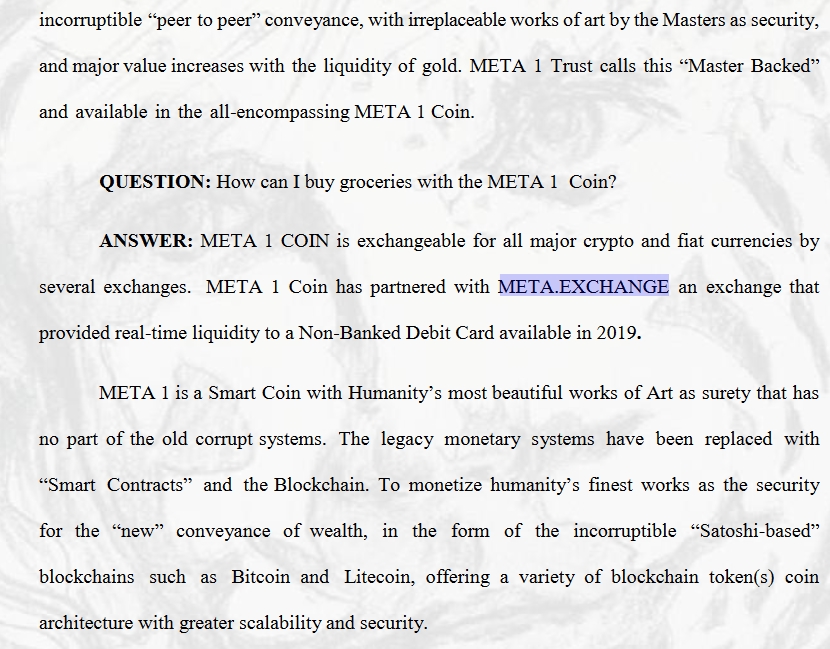

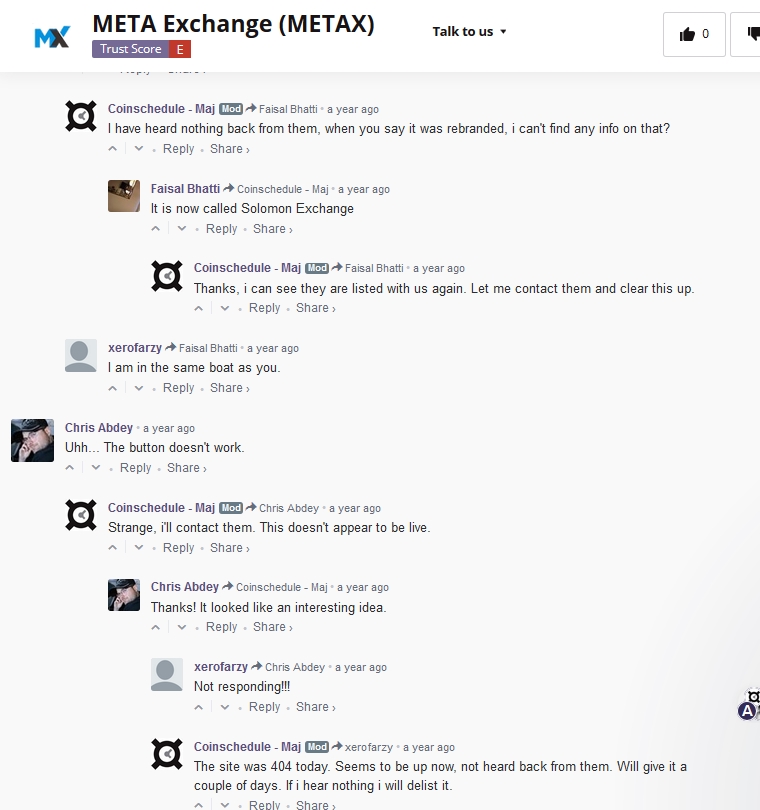

Inside Dave "the Douchebag" Schmidt's Meta 1 Scam - "The Defunct Exchange" 12/27/18

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:43 am

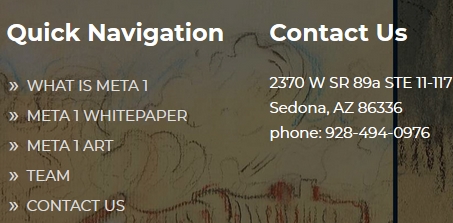

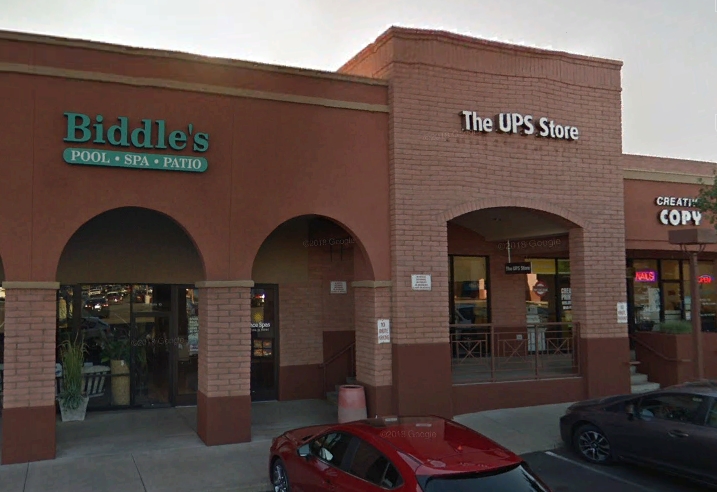

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:43 am Inside Dave "the Douchebag" Schmidt's Meta 1 Scam - "Financing" 12/27/18

Inside Dave "the Douchebag" Schmidt's Meta 1 Scam - "Financing" 12/27/18

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 1:09 am

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 1:09 am

That nut Nicole is the "CEO"s girlfriend! Fri Dec 28, 2018 10:27 am

That nut Nicole is the "CEO"s girlfriend! Fri Dec 28, 2018 10:27 am Bizarre CEO and Nicole Vid!!They look stoned!! Fri Dec 28, 2018 12:04 pm

Bizarre CEO and Nicole Vid!!They look stoned!! Fri Dec 28, 2018 12:04 pm Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:33 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:33 pm Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:56 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 12:56 pm Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 1:00 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Dec 28, 2018 1:00 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Jan 04, 2019 10:13 pm

Re: Dave Schmidt new scam - Meta1 Coin Fri Jan 04, 2019 10:13 pm Re: Dave Schmidt new scam - Meta1 Coin Sat Jan 05, 2019 10:40 am

Re: Dave Schmidt new scam - Meta1 Coin Sat Jan 05, 2019 10:40 am Re: Dave Schmidt new scam - Meta1 Coin Mon Jan 07, 2019 12:24 pm

Re: Dave Schmidt new scam - Meta1 Coin Mon Jan 07, 2019 12:24 pm This scam is similar to Meta1 Coin Mon Jan 07, 2019 1:26 pm

This scam is similar to Meta1 Coin Mon Jan 07, 2019 1:26 pm Re: Dave Schmidt new scam - Meta1 Coin Wed Jan 09, 2019 12:33 am

Re: Dave Schmidt new scam - Meta1 Coin Wed Jan 09, 2019 12:33 am