IRS Warns Americans To Report Annual PayPal, Venmo Transactions Exceeding $600 Per Year

November 28, 2022

By Tyler Durden

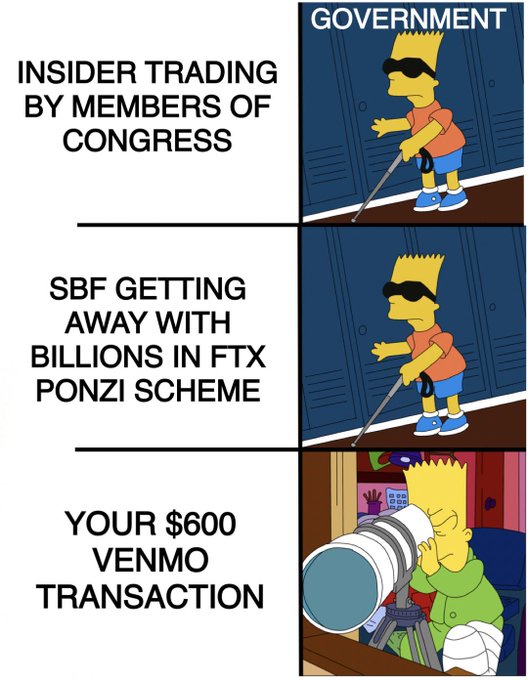

The Internal Revenue Service is warning Americans that they need to prepare to report transactions of at least $600 per year through ‘third-party’ payment processors such as Venmo and PayPal.

In a notice posted Tuesday to irs.gov, businesses and the self-employed are warned that cumulative income of at least $600 per year through apps – which also include Zelle and Cash App – will need to be reported on a tax form known as 1099-K, according to Marketwatch.

According to the agency, the notice is primarily aimed at part-time workers, those with side-gigs and people selling goods. It does not apply to non-commercial transactions such as reimbursing people, or one-off transactions such as selling old furniture, Marketwatch reports.

That said – considering that the 3rd party providers are going to start reporting transactions exceeding $600, how will the IRS know you’re selling ‘old furniture’ versus, say, sweaters made out of cat hair on Ebay?

Source: ZeroHedge

THANKS TO: https://www.activistpost.com/2022/11/irs-warns-americans-to-report-annual-paypal-venmo-transactions-exceeding-600-per-year.html

November 28, 2022

By Tyler Durden

The Internal Revenue Service is warning Americans that they need to prepare to report transactions of at least $600 per year through ‘third-party’ payment processors such as Venmo and PayPal.

In a notice posted Tuesday to irs.gov, businesses and the self-employed are warned that cumulative income of at least $600 per year through apps – which also include Zelle and Cash App – will need to be reported on a tax form known as 1099-K, according to Marketwatch.

According to the agency, the notice is primarily aimed at part-time workers, those with side-gigs and people selling goods. It does not apply to non-commercial transactions such as reimbursing people, or one-off transactions such as selling old furniture, Marketwatch reports.

That said – considering that the 3rd party providers are going to start reporting transactions exceeding $600, how will the IRS know you’re selling ‘old furniture’ versus, say, sweaters made out of cat hair on Ebay?

In short, this will undoubtedly raise taxes on people making under $400,000 per year.Before this year, the threshold for filing a Form 1099-K report was at least 200 transactions totaling an aggregate of at least $20,000.

When Congress passed the American Rescue Plan Act of 2021, it included a provision that reduced the reporting threshold to a single transaction over $600.

The Biden administration hopes that by reducing the threshold, the measure will crack down on Americans evading taxes by not reporting the full extent of their gross income. -MarketWatch

Source: ZeroHedge

THANKS TO: https://www.activistpost.com/2022/11/irs-warns-americans-to-report-annual-paypal-venmo-transactions-exceeding-600-per-year.html

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo