Big Trouble In Little Banks - Bailout Sparks Buying Panic In Bonds, Bitcoin, & Bullion

by Tyler Durden

Monday, Mar 13, 2023 - 08:02 PM

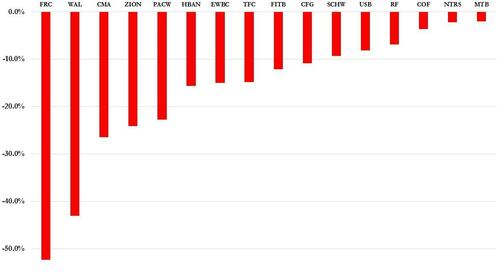

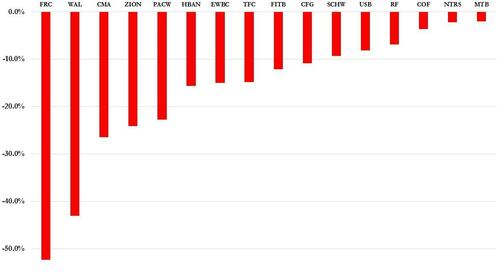

The Fed/TSY/FDIC stepped in and saved the world again last night... but nobody told regional banks, whose shares are down dramatically today...

Admittedly off the lows of the day, but all with multiple trading halts today. FRC, WAL, and MYFW are the highest default risk banks in the Russell 3000 Banks Subsector, according to Bloomberg...

Source: Bloomberg

But it's not just the small banks who are seeing default risk increase, all of the global majors are seeing CDS spreads rise...

Source: Bloomberg

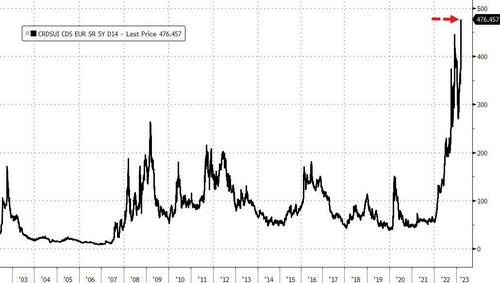

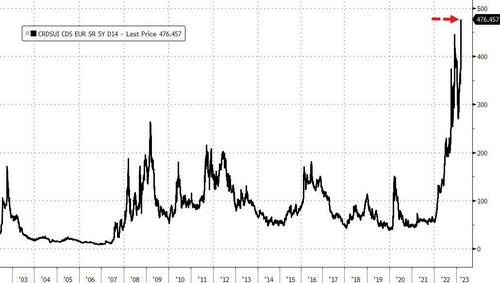

And Credit Suisse CDS has never closed higher (and is now more than double the risk than at the peak of the financial crisis)...

Source: Bloomberg

With the regional bank index continuing to crash-land...

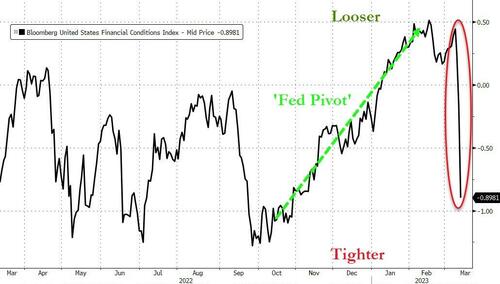

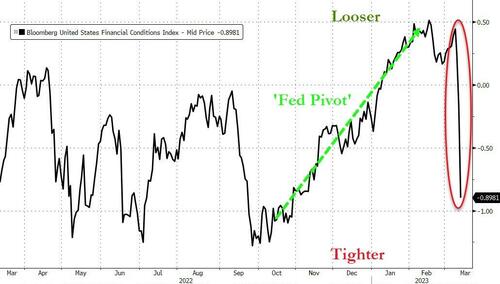

After a year of hiking rates and hawkish FedSpeak, all it took to tighten financial conditions drastically was a open-ended facility to bail out the financial system. Bloomberg's financial conditions index tightened massively overnight...

Source: Bloomberg

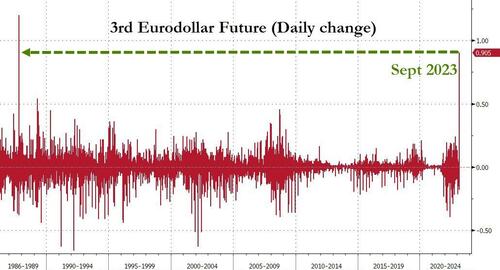

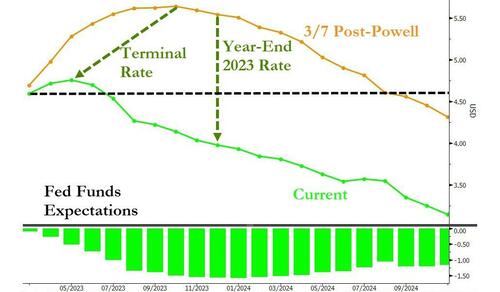

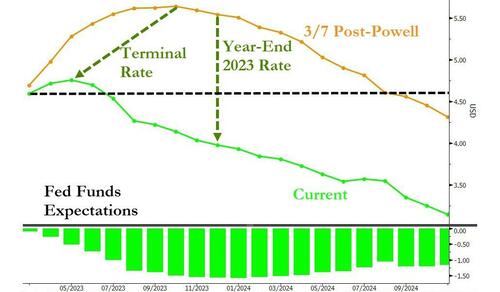

And the market has completely blown up any hopes that The Fed had for a hawkish path from here with the terminal rate plunging and significant rate-cuts being priced in. For context, the market expected over 110bps of rate-hikes by September on Wednesday, it now believes that by September, rates will be over 65bps lower... "in the words of the Virgin Mary, come again!"

Source: Bloomberg

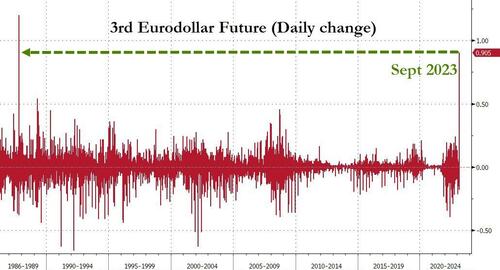

For context, today was the biggest gain in the 3rd ED contact (which is currently the Sept 2023 contract) since 1987...

Source: Bloomberg

The shift in the market's expectation for the Fed's rate trajectory is simply stunning...

Source: Bloomberg

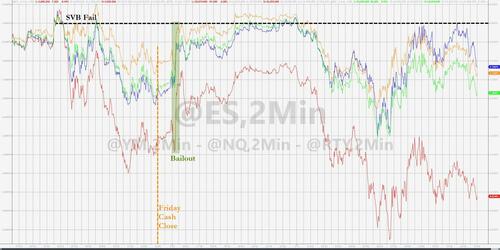

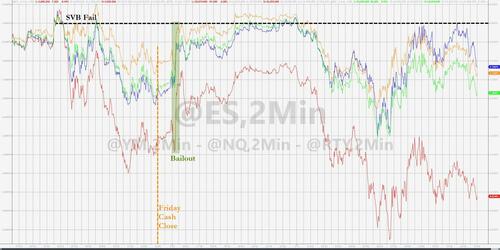

Stocks rallied after the bailout, but we note that the US Majors were unable to get back to pre-SVB-Fail levels. Small Caps (heavy with financials) have been clubbed like a baby seal...

Notably, 0DTE players faded the initial rebound in stocks...

HIRO Indicator | SpotGamma

And obviously, financials were the biggest losers. On the flip-side, only defensives were bid (Healthcare and Utes)...

Source: Bloomberg

Credit markets blew out today (on a spread basis), exceeding (relatively) the shift in equity risk...

Source: Bloomberg

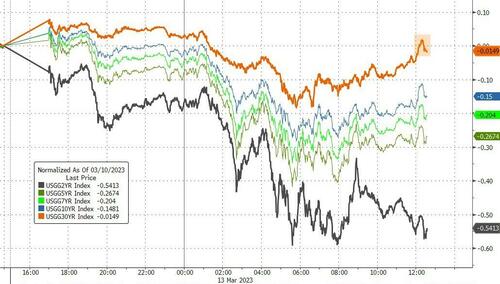

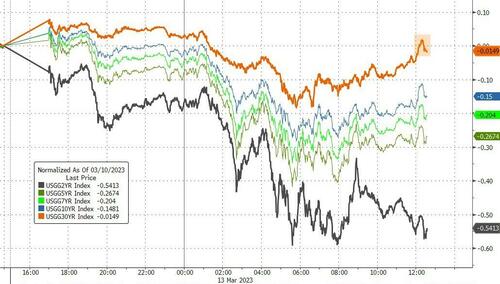

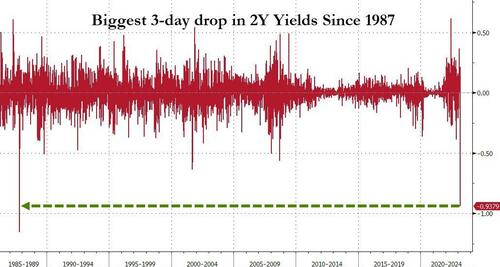

Bonds were aggressively bid across the curve with the short-end a massive outperformer over the last three days.

Source: Bloomberg

On the day, the 30Y yields ended unchanged with 2Y down over 50bps..

Source: Bloomberg

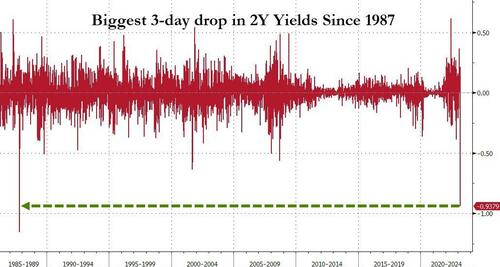

The 2Y yield is down almost 100bps in the last three days, dropping back below 4.00% - its lowest since Sept 2022...

Source: Bloomberg

...the biggest yield drop since 'Black Monday' in 1987...

Source: Bloomberg

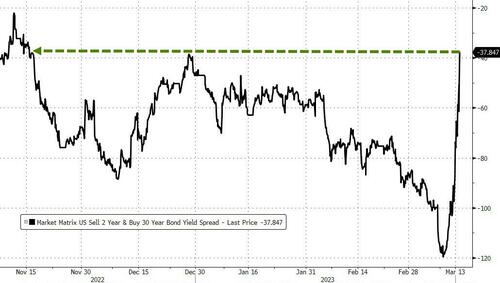

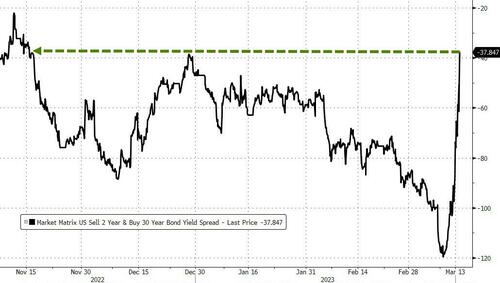

The yield curve steepened dramatically with 2s30s up over 50bps today to their least inverted since mid-Nov...

Source: Bloomberg

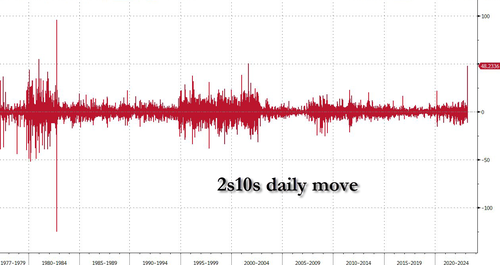

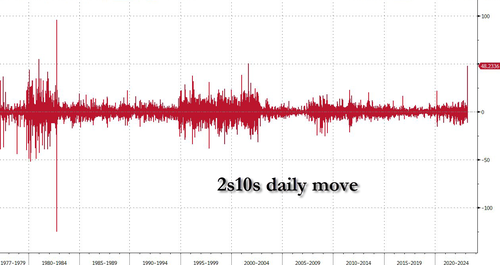

Well, Powell is officially Volcker: the 2s10s just steepened at the fastest pace since the Volcker economic crematorium unleashed the worst recession since World War 2

[url=https://www.zerohedge.com/s3/files/inline-images/image -] [/url]

[/url]

Source: Bloomberg

The market's inflation expectations (1Y CPI Swaps) plunged...

Source: Bloomberg

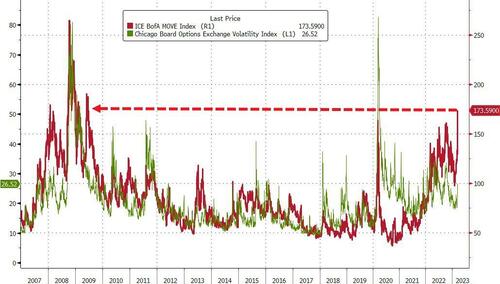

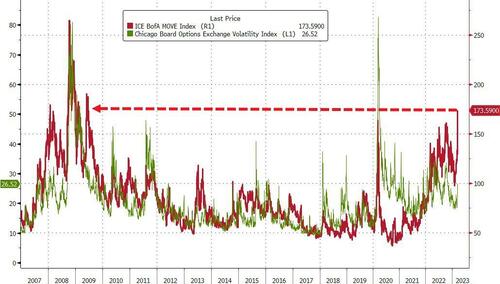

Bond volatility (MOVE) exploded today to its highest since June 2009...

Source: Bloomberg

Shorter-term, the decoupling between VIX and MOVE from late Feb is starting to unwind, but equity risk has a long way to go...

Source: Bloomberg

The dollar dumped down to three-week lows...

Source: Bloomberg

As alternative-currencies were sought as safe-havens, sending bitcoin soaring higher (above $24,000)...

Source: Bloomberg

And gold spiked above $1900...

Oil prices puked overnight, with WTI down to a $72 handle before bouncing back, but late on, it started to slide again, ending down over 3%...

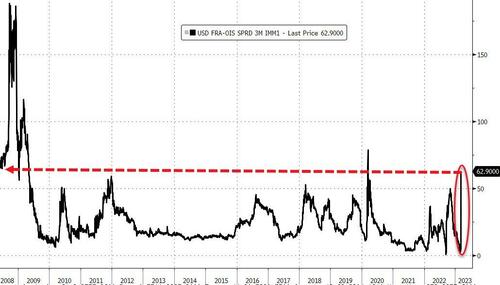

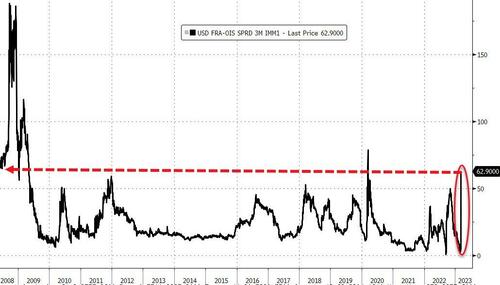

Finally, systemic risk indicators are starting to flash red with FRA-OIS spiking (signaling stress in the banking system)...

Source: Bloomberg

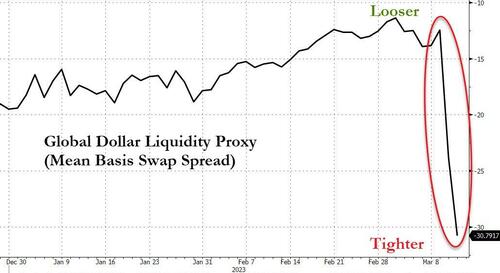

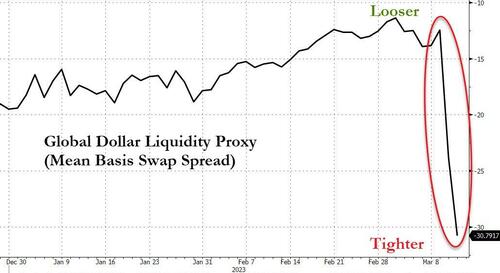

And global dollar liquidity is drying up fast...

Source: Bloomberg

But Biden said "the banking system was safe"

MORE HERE: https://www.zerohedge.com/markets/big-trouble-little-banks-bailout-sparks-buying-panic-bonds-bitcoin-bullion?utm_source=&utm_medium=email&utm_campaign=1295

by Tyler Durden

Monday, Mar 13, 2023 - 08:02 PM

The Fed/TSY/FDIC stepped in and saved the world again last night... but nobody told regional banks, whose shares are down dramatically today...

Admittedly off the lows of the day, but all with multiple trading halts today. FRC, WAL, and MYFW are the highest default risk banks in the Russell 3000 Banks Subsector, according to Bloomberg...

Source: Bloomberg

But it's not just the small banks who are seeing default risk increase, all of the global majors are seeing CDS spreads rise...

Source: Bloomberg

And Credit Suisse CDS has never closed higher (and is now more than double the risk than at the peak of the financial crisis)...

Source: Bloomberg

With the regional bank index continuing to crash-land...

After a year of hiking rates and hawkish FedSpeak, all it took to tighten financial conditions drastically was a open-ended facility to bail out the financial system. Bloomberg's financial conditions index tightened massively overnight...

Source: Bloomberg

And the market has completely blown up any hopes that The Fed had for a hawkish path from here with the terminal rate plunging and significant rate-cuts being priced in. For context, the market expected over 110bps of rate-hikes by September on Wednesday, it now believes that by September, rates will be over 65bps lower... "in the words of the Virgin Mary, come again!"

Source: Bloomberg

For context, today was the biggest gain in the 3rd ED contact (which is currently the Sept 2023 contract) since 1987...

Source: Bloomberg

The shift in the market's expectation for the Fed's rate trajectory is simply stunning...

Source: Bloomberg

Stocks rallied after the bailout, but we note that the US Majors were unable to get back to pre-SVB-Fail levels. Small Caps (heavy with financials) have been clubbed like a baby seal...

Notably, 0DTE players faded the initial rebound in stocks...

HIRO Indicator | SpotGamma

And obviously, financials were the biggest losers. On the flip-side, only defensives were bid (Healthcare and Utes)...

Source: Bloomberg

Credit markets blew out today (on a spread basis), exceeding (relatively) the shift in equity risk...

Source: Bloomberg

Bonds were aggressively bid across the curve with the short-end a massive outperformer over the last three days.

Source: Bloomberg

On the day, the 30Y yields ended unchanged with 2Y down over 50bps..

Source: Bloomberg

The 2Y yield is down almost 100bps in the last three days, dropping back below 4.00% - its lowest since Sept 2022...

Source: Bloomberg

...the biggest yield drop since 'Black Monday' in 1987...

Source: Bloomberg

The yield curve steepened dramatically with 2s30s up over 50bps today to their least inverted since mid-Nov...

Source: Bloomberg

Well, Powell is officially Volcker: the 2s10s just steepened at the fastest pace since the Volcker economic crematorium unleashed the worst recession since World War 2

[url=https://www.zerohedge.com/s3/files/inline-images/image -]

[/url]

[/url]Source: Bloomberg

The market's inflation expectations (1Y CPI Swaps) plunged...

Source: Bloomberg

Bond volatility (MOVE) exploded today to its highest since June 2009...

Source: Bloomberg

Shorter-term, the decoupling between VIX and MOVE from late Feb is starting to unwind, but equity risk has a long way to go...

Source: Bloomberg

The dollar dumped down to three-week lows...

Source: Bloomberg

As alternative-currencies were sought as safe-havens, sending bitcoin soaring higher (above $24,000)...

Source: Bloomberg

And gold spiked above $1900...

Oil prices puked overnight, with WTI down to a $72 handle before bouncing back, but late on, it started to slide again, ending down over 3%...

Finally, systemic risk indicators are starting to flash red with FRA-OIS spiking (signaling stress in the banking system)...

Source: Bloomberg

And global dollar liquidity is drying up fast...

Source: Bloomberg

But Biden said "the banking system was safe"

MORE HERE: https://www.zerohedge.com/markets/big-trouble-little-banks-bailout-sparks-buying-panic-bonds-bitcoin-bullion?utm_source=&utm_medium=email&utm_campaign=1295

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo