Everyone Is Just Pretending Nothing's Wrong

by Tyler Durden

Monday, Mar 27, 2023 - 11:20 AM

Submitted by QTR's Fringe Finance

Even if the stock market holds up, something is going to have to break in a big way.“It is a shit storm out here. You have no idea the kind of crap people are pulling, and everyone’s walking around like they’re in a goddamn Enya video.” - Mark Baum

This is about the simplest way I can try and explain how I feel about the state of the economy and markets, delivered to you honestly and devoid of detail, as someone who truly neither has the patience nor the attention span to dive into the intricacies of the Eurodollar system or the path printed money takes during QE or QT.

The fact is that I just don’t care about how the bowels of the system works. I don’t need to care. All I need to know is that money creation as a method of “solving” recessions can’t continue in perpetuity: the dollar amounts necessary for bailouts become astronomical, too quickly, and inflation becomes a pressing issue. Then, as we are now, Central Bankers get stuck between an “inflation vs. recession” rock and hard place. It’s a flawed system that once exploited a loophole (money printing) to slap band-aids on problems. We then thought we could do it in perpetuity to keep ourselves and voters consistently comfortable by presenting the illusion that everything had done “back to normal” - and now we’re finally going to have to deal with very uncomfortable consequences of our actions.

How’s that for a book report from someone who didn’t actually read the book? And I didn’t even need to mention “swaps” or “interest rate futures” to fake sounding smart.

Putting aside what bureaucrats are saying about deposit insurance and Fed policy in the midst of the banking crisis we are having, underneath it all people seem to be forgetting that the economy has just tapped into a large pool of chaos and unrest in the form of 4% interest rates we’re supposedly using to fight inflation.

CNBC.com

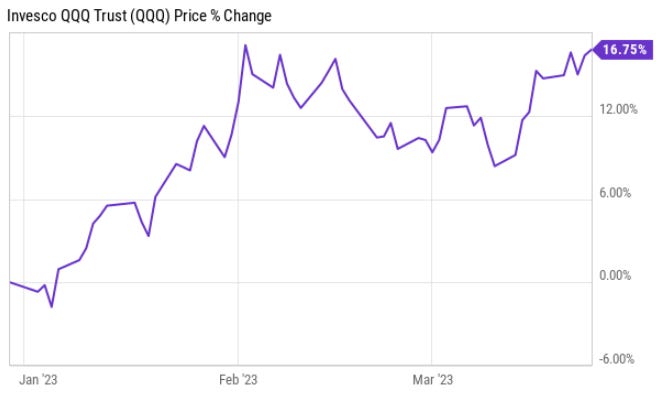

And just as was the case with Covid, the headlines today don’t seem to match the reality of what’s happening in markets. Are we to honestly believe that, in the face of a cascade of bank failures that has now encompassed Silicon Valley Bank and Credit Suisse, with names like Charles Schwab and Deutsche Bank also being tossed around, that a real “flight to safety” is people pouring their money into the Nasdaq QQQ ETF at 27x earnings? Because that’s what’s happening.

Of course this is simply the residual effect of too much liquidity in the system, behavioral incentives that have reversed free market poles over the last 30 years and a stock market that has been coddled, babied, micromanaged and manipulated to the point of no longer making any sense.

The further we stray off the path, the closer we get to something having to give.

Powell and Yellen

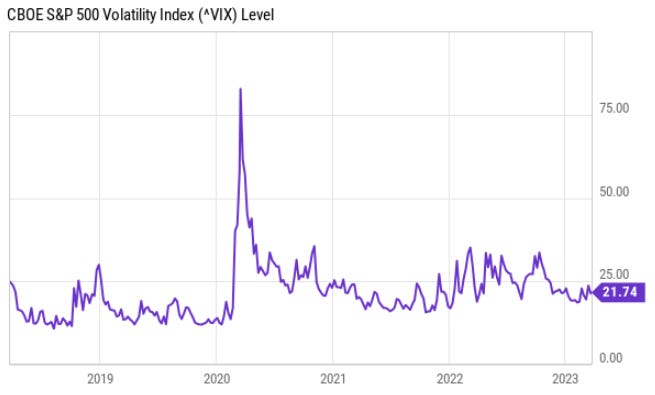

I think the key point I am trying to make today is that I strongly continue to believe we have not seen the last - or even the beginning, really - of the volatility we’re in store for as a result of rate hikes.

In addition to bank failures, headlines like this one about hedge funds taking on huge losses thanks to the plunge in bond prices are going to become more common place.

When there’s over $1 trillion still floating around in the crypto ecosystem and tech stocks are the “risk off” trade, you know we haven’t experienced even a modicum of fear or capitulation yet. It’s the same hubris and arrogance we had during QE infinity.

And we’ll keep this “plan” until, in the parlance of Mike Tyson, we are eventually “punched in the mouth” by something we didn’t see coming.

The question is: what is going to break, and when?

The answer I have for you today: who the hell knows?

We’re already starting to see a flight into gold and silver, probably as a hedge against the system and inflation at once, as well as a response to the idea that the Fed is likely to pause, then pivot, soon. In the last 6 months, gold is pushing a 20% rise:

This move in the metals has taken place before Jerome Powell has alluded to rate cuts.

In fact, last week he said that rate cuts were not a part of the Fed’s base case. As I have been saying for months, I still expect the market to tank at some point, which will then cause the Fed to hurriedly step in with rate cuts. Not only have we not seen a sell off yet, we haven’t even seen the suggestion of a sell off.

When I try to visualize the Fed’s priorities, based on their spineless action over the last couple decades, all I can think about is that they’re going to want to protect the price of stocks at any cost.

In other words, soaring inflation by more money printing is okay with them, as long as the nominal price of assets keeps going up. Rising nominal asset prices always seems to trump letting the economy crash for the Fed. Why? Because the former “solution” widens the inequality gap and protects those with assets (the rich), while the latter would actually contract the inequality gap and disproportionately harm those with assets (the rich).

In a scenario where the Fed lets the economy crash instead of surrendering to inflation, the rich would be most susceptible to taking real losses. And we can’t have that, can we?

Now say, instead, that the Fed tries to walk a thin line between inflation and recession. Something will still have to break, it may just not be as pronounced or as quick if the central bank commits to one of the other. And by “break” I don’t just mean the economy wrecking somewhere, I mean it showing up in the price of something…somewhere.

Take a look out there and you can find a case for pretty much any story you want to tell yourself. There’s analysts saying gold will go to $8,000, there’s analysts saying oil could go to $300, there’s analysts saying the Dow Jones will go to 50,000, there’s analysts saying copper is going to 20x and there’s analysts saying the bond market will crack up in the face of yield curve control.

All of a sudden my brutal honesty of admitting I don’t have a clue what’s going to happen next looks pretty good, right?

The point is that while everybody has a different take on what the specific malfunction is going to be, it all falls under the umbrella of agreeing there is going to be some major malfunction in prices somewhere. I’d love to tell you, Jim Simons-style, that I have some theoretical mathematic opinion on the situation, but the fact is, I’m just kind of sitting around, Eastwood-in-Gran-Torino-style, sipping a beer waiting for something to blow up.

The easy, broader point that I’m trying to make is that the complacency in the market we are witnessing currently is outrageous.

The market will do what it will - I can’t control that. But what I can control is how closely I am watching and paying attention. I truly believe we are in the calm before a very big storm in equity markets, so I’m focused acutely on day-to-day sentiment. There will come a time when “fear mongering” stops and I think the market will be on autopilot again. But that time isn’t now.

In fact, someone should inform Sara Eisen and CNBC that the “fear mongering” has now made its way to CNN.

Meanwhile the blow up of Silicon Valley Bank and the ensuing swings in the market haven’t pushed volatility levels to any type of alarming level, especially when compared to the onset of the pandemic.

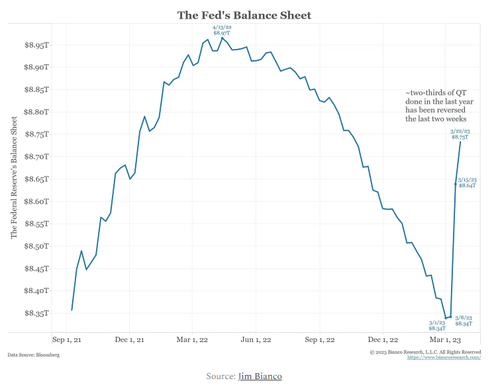

And let us not forget that, underneath it all, we still have to deal with the very real consequences of not dealing with consequences for the last several decades. Once again, it is time to take the medicine from our terrible monetary policy and that, in turn, is going to require a much larger response than it ever has from central banks.

Most of the quantitative tightening that the Federal Reserve has already performed has been put back on the central bank’s balance sheet already. Now, the gate will swing wildly in the other direction as the Fed’s balance sheet inevitably starts to grow once again.

I know I repeat myself a lot talking about this stuff, but it is so important to realize: the fed is still raising rates.

Again, for the millionth time, these rate hike (or cut) moves affect the economy with a lag. Silicon Valley Bank blowing up was the result of rate hikes that took place probably six months to a year ago.

That means we have six months to a year of rate hikes that haven’t been “processed” through the economy yet.

I would guess that there are blowups happening as you read this. I guarantee you there are compliance officers in the back room of a major hedge fund somewhere right now, examining the size and scope of a massive blowup that is about to take place (or has already), that nobody knows about yet.

But in time, all of these blowups and failures will be revealed. And then, it isn’t as though they’ve just magically worked their way out of the system and we can all go about our business. You then have all of the counterparties that need to be looked at and scrutinized carefully. On top of that, every new blowup chips away a little bit more at psychology and sentiment in the market, encouraging a risk off attitude and increasing the likelihood of another blowup. Yikes.

Again, I do think the Fed will ride to the rescue here, but only once the market smashes into something hard and immovable. If the stock market was a bowling ball dropped off the roof of a 100 story building and the Fed only stepped in to react after it smashed into the sidewalk, it would still be at about the 98th floor right now.

I’d love to hear your thoughts in the comments in this free discussion here about what part of the market you think is going to blow up first, where it will reflect the most in prices, and what you think the Fed’s “plan” is going forward.

Share | Subscribe and get 65% off today

QTR’s Disclaimer: I am not a guru or an expert. I am an idiot writing a blog and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning and generally trade like a degenerate psychopath. This is not a recommendation to buy or sell any stocks or securities or any asset class - just my opinions of me and my guests. I often lose money on positions I trade/invest in and I’m sure have lost more than I’ve made in my time in markets. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. Positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it three times because it’s that important.

MORE HERE: https://www.zerohedge.com/markets/everyone-just-pretending-nothings-wrong?utm_source=&utm_medium=email&utm_campaign=1367

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo