57 Banks and Financial Institutions Certified for FedNow Instant Payments – Fed President Admits Withdrawals Can be Limited

by Brian Shilhavy

Editor, Health Impact New

57 “early adopter organizations” have now been certified to participate in the U.S. Federal Reserve’s FedNow instant payments program that will be rolled out later this month (July, 2023).

Here is the list of organizations that have completed certification in the FedNow Service:On June 29, 2023, the Federal Reserve announced that 57 early adopter organizations, including financial institutions and service providers, had completed formal testing and certification on the FedNow Service in advance of its launch in late July. Many of these organizations will be live when the FedNow Service launches or shortly after, with financial institutions ready to send and receive transactions and service providers ready to support transaction activity.

This group of early adopters is now performing final trial runs on the service to confirm their readiness to support live transactions over the new instant payments infrastructure. The early adopters include 41 financial institutions participating as senders, receivers and/or correspondents supporting settlement, 15 service providers processing on behalf of participants, and the U.S. Department of the Treasury.

In addition to the initial adopters, the Federal Reserve continues to work with and onboard financial institutions and service providers planning to join later in 2023 and beyond, as the initial step to growing a robust network aimed at reaching all 10,000 U.S. financial institutions. (Source.)

Participants

- 1st Bank Yuma

- 1st Source Bank

- Adyen

- Alloya Corporate Federal Credit Union

- Atlantic Community Bankers Bank

- Avidia Bank

- Bankers’ Bank of the West

- BNY Mellon

- Bridge Community Bank

- Bryant Bank

- Buffalo Federal Bank

- Catalyst Corporate Federal Credit Union

- Community Bankers’ Bank

- Consumers Cooperative Credit Union

- Corporate America Credit Union

- Corporate One Federal Credit Union

- Eastern Corporate Federal Credit Union

- First Internet Bank of Indiana

- Global Innovations Bank

- HawaiiUSA Federal Credit Union

- JPMorgan Chase

- Malaga Bank

- Mediapolis Savings Bank

- Michigan Schools & Government Credit Union

- Millennium Corporate Credit Union

- Nicolet National Bank

- North American Banking Company

- PCBB

- Peoples Bank

- Pima Federal Credit Union

- Quad City Bank & Trust

- Salem Five Bank

- Star One Credit Union

- The Bankers Bank

- United Bankers’ Bank

- U.S. Bank

- U.S. Century Bank

- U.S. Department of the Treasury’s Bureau of the Fiscal Service

- Veridian Credit Union

- Vizo Financial Corporate Credit Union

- Wells Fargo Bank, N.A.

Service Providers

- ACI Worldwide Corp.

- Alacriti

- Aptys Solutions

- ECS Fin Inc.

- Finastra

- Finzly

- FIS

- Fiserv Solutions, LLC

- FPS GOLD

- Jack Henry

- Juniper Payments, a PSCU Company

- Open Payment Network

- Pidgin, Inc.

- Temenos

- Vertifi Software, LLC

What is FedNow?

From the source:

The FedNow Service is a new instant payment infrastructure developed by the Federal Reserve that allows financial institutions of every size across the U.S. to provide safe and efficient instant payment services.

Through financial institutions participating in the FedNow Service, businesses and individuals can send and receive instant payments in real time, around the clock, every day of the year. Financial institutions and their service providers can use the service to provide innovative instant payment services to customers, and recipients will have full access to funds immediately, allowing for greater financial flexibility when making time-sensitive payments.

The FedNow Service will be deployed in phases, with the initial launch taking place July 2023.

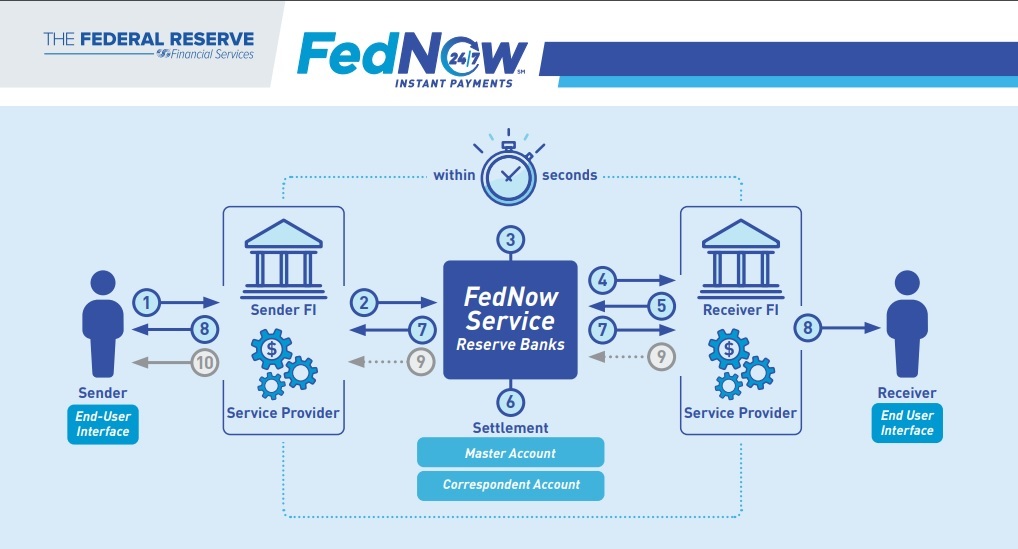

The video below follows a payment over the FedNow Service from start to finish, highlighting what financial institutions need to know about their role in the process.

Cleveland Federal Reserve President Loretta Mester Admits Banks Can Limit Withdrawals via FedNow to Avoid “Banking Crisis”

Cleveland Federal Reserve President Loretta Mester. Image source.

Cleveland Federal Reserve President Loretta Mester stated yesterday that the FedNow program “should help ensure financial stability should bank stress arise,” by limiting withdrawals.

I wonder how the Federal Reserve is defining “customer type”?Banks can manage outflow risk in Fed’s new payment service system, Mester says

Cleveland Federal Reserve President Loretta Mester said on Wednesday that the U.S. central bank’s new real-time money moving system is being designed in a way that should help ensure financial stability should bank stress arise.

Mester acknowledged concerns that FedNow, a real-time, all-hours payment system the central bank is making available to banks, could exacerbate banking troubles by facilitating fast outflows from financial institutions, in effect super-charging a potential bank run.

She said it will be up to the users of FedNow themselves to use transfer limits.

“Banks have tools they could use to mitigate large outflows of deposits,” including limiting how much money can be moved over a given period, restricting who can use the system, and firms can determine which direction money can flow in real time, Mester said in a speech to the National Bureau of Economic Research Summer Institute.

“Future releases of the FedNow Service may allow configurable transaction limits by customer type, if such limits are deemed useful,” she added. (Full article. Emphasis added.)

Is the Fed Eliminating their Competition in Instant Payments with FedNow?

Last month (June, 2023), I reported how The Consumer Financial Protection Bureau (CFPB), an organization linked to the Federal Reserve, published a warning to consumers stating that funds held in popular online payment apps, such as Paypal, Cash App, and Venmo, lack FDIC insurance and should be transferred to “insured banks and credit unions.” See:

Setting the Stage for Bank Failures and Rollout of FedNow? U.S. Government Warns Consumers Not to Keep Money in Venmo, CashApp, and PayPal

I wrote:And sure enough, Cleveland Federal Reserve President Loretta Mester did address this issue in her update on FedNow yesterday, stating that “it may seem more efficient to have fewer rails for smaller-transaction payments.”The Fed is basically warning you ahead of time that you are going to lose that money if you keep it there.

Are Mester’s comments about peer-to-peer payments a warning to existing apps like PayPal, Venmo, and others that they better link in to the new FedNow system or be eliminated?A Regional Fed Official Sees FedNow Consolidating Networks And Adding P2P

With the Federal Reserve’s rollout of the FedNow real-time payments service expected by the end of the month, a regional Federal Reserve Bank official on Wednesday outlined a roadmap for the new network that includes network interoperability, the possible addition of peer-to-peer payments, and, overall, the prospect of fewer payment systems overall.

While predicting that volume, particularly “time-sensitive” payments, will shift to FedNow, Mester conceded existing payments systems could play a role as alternatives to the Fed network when needed.

“In thinking about the evolution of the [established] payment rails, it may seem more efficient to have fewer rails for smaller-transaction payments, but those efficiencies need to be balanced with ensuring that the payment system has sufficient redundancy to remain resilient,” she said.

One popular consumer application for FedNow could be peer-to-peer payments, Mester said. This is a service that has already drawn major payments players like PayPal, Venmo, and Early Warnings Services LLC’s Zelle network. “Financial institutions would like to be able to use FedNow to offer person-to-person … payment services whereby customers can originate a payment using an alias such as an email address or phone number,” she noted. (Source.)

While she added that FedNow at the start will not have a directory function needed to undergird a P2P service, there are alternative approaches, she said.

“Instead, a bank could use a private-sector directory to access routing information in order to transmit alias-based payments on FedNow,” Mester noted. “The Fed is looking at various approaches to provide alias-based payments as a way to enhance the FedNow Service in the future.” (Source.)

Is this the Beginning of the End to Private Banking?

When private banks and financial institutions, including existing payment apps, decide to become part of FedNow, will they be required to surrender all the account information of their customers doing business with them?Yes, apparently they will, based on “Operating Circular 1 (OC 1)“, a document on the Federal Reserve website under “Rules and Regulations Resources.”

In that document, Section 6.0 deals with “FEDERAL RESERVE BANK RESPONSE PROGRAM FOR UNAUTHORIZED ACCESS TO SENSITIVE CONSUMER INFORMATION OBTAINED IN THE COURSE OF PROVIDING FINANCIAL SERVICES.”

Section 6.1, “THE RESERVE BANK’S POSSESSION AND USE OF CONSUMER INFORMATION” states:

In other words, the Fed needs all of your “Sensitive” information to protect you from “hackers.”The Reserve Banks do not hold accounts for individuals and do not provide Reserve Bank services to individuals. In the course of providing Financial Services to Depository Institutions and other authorized users of Reserve Bank services, the Reserve Banks obtain, store, and transmit information that includes Sensitive Consumer Information.

Under the general supervision of the Board of Governors, the Reserve Banks have implemented information security measures designed to protect the security and confidentiality of nonpublic personal information obtained by them, to protect against any anticipated threats or hazards to the security or integrity of such information, and to protect against unauthorized access to or use or reuse of such information that could result in substantial harm or inconvenience to a Depository Institution’s customer.

What is that “Sensitive Consumer Information”?

Section 6.2 defines that:

How convenient. So when they are ready to roll out CBDCs and establish an account for you at the Federal Reserve, they will already know everything about you and be able to open an account for you, even if you choose not to participate, if your bank was already participating in the FedNow program.Sensitive Consumer Information means a consumer’s name, address or telephone number, in conjunction with the consumer’s social security number, driver’s license number, account number, credit or debit card number, or a personal identification number or password that would permit access to the consumer’s account, if the Reserve Bank or any other party that holds Sensitive Consumer Information as an agent of the Reserve Bank obtains such information in the course of providing Financial Services. (Source.)

This will save months, if not years, in trying to collect this data in order to implement CBDCs.

Enrollment in the FedNow Instant Payment program is still voluntary at this point, so NOW is the time to start asking questions of your bank or other financial institution if they are on the above list and have already been certified to participate in FedNow.

Let them know that you choose NOT to participate in any of these instant payment services that utilize FedNow, and that you do NOT consent to them handing over your account information to the Federal Reserve.

THANKS TO: https://healthimpactnews.com/2023/57-banks-and-financial-institutions-certified-for-fednow-instant-payments-fed-president-admits-withdrawals-can-be-limited/

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo