Restored Republic via a GCR as of Sept. 10, 2017

9/10/2017 12:29:00 AM Dinarland, GCR, Geopolitics, [url=http://operationdisclosure.blogspot.com/search/label/Restored Republic]Restored Republic[/url], RV, [url=http://operationdisclosure.blogspot.com/search/label/Secret News]Secret News[/url], [url=http://operationdisclosure.blogspot.com/search/label/US Republic]US Republic[/url]

Restored Republic via a GCR Update as of Sept. 10 2017 Compiled 12:01 am EDT 10 Sept. 2017 by Judy Byington, MSW, LCSW, ret, CEO, Child Abuse Recovery www.ChildAbuseRecovery.com; Author, "Twenty Two Faces," www.22faces.com

Source: Dinar Chronicles A. Calculating your Zim exchange: Judy Note: The below is my understanding of how to calculate your Zim exchange under the new regulations announced yesterday, Sept. 8. It was suggested that before you go to your exchange appointment that you calculate your Zim exchange as explained below to see if you want to take the Zim screen rate, or go for a higher negotiated rate. The higher rates would require signing a more restrictive Non Disclosure Agreement. This is my opinion, only my opinion, and was based on Yosef's, Bruce's and RayRen98's intel this week. Please use your own discernment to make decisions on the matter. 1. On

Sept. 8 2017 new and non-negotiable instructions about exchanging Zim were announced.

2. The Zim was not a currency, but a Bond of the country of Zimbabwe. It was inherent in exchanging the Zim Bond that the money be used for humanitarian purpose for the Zimbabwe people.

3. The Zim exchange would be split 20% for the redeemer, with 80% dedicated to a Zimbabwe charity.

4. The Zim redeemer could pick the charities that received this 80% of their exchange, but those charities had to be chartered, registered, and domiciled in Zimbabwe.

8. Of the 20% of the principle allocated to the redeemer, 5% of that principle would be paid out through a 25 year payout plan.

9. The remaining 15% of the principle amount allocated to the redeemer would stay at the HSBC bank for 25 years.

10. This 15% of the principle that stayed at the bank for 25 years would earn 5% interest - to be paid out to the redeemer every 30 days.

11. At the end of that 25 years the redeemer could then be paid their 15% of the principal left at the bank, or could choose to renew their contract with the bank in 5 year intervals. (That is, continue to receive 5% interest on the amount left at the bank for the next 5 years).

12. All earned interest would be taxed, though could be paid directly into a non-taxable trust account.

13. Example of a 100 Trillion Zim Bond Note exchanged at a $3.00 rate:

A. 100 T Zim note exchanged at a $3.00 rate = $300,000,000,000,000 (or $300 Trillion)

B. Of that $300 Trillion, 80% (or $240 Trillion), would be dedicated to Zimbabwe charities.

C. Of that $300 Trillion, 20% (or $60 Trillion) would be paid to the redeemer.

D. Of that $60 Trillion paid to the redeemer, 5% (or $3 Trillion) would be paid out to the redeemer over a 25 year period, (or at a rate of $120 Billion per year).

E. Of that $60 Trillion paid to the redeemer, 15% (or $9 Trillion) would remain at HSBC.

F. That $9 Trillion remaining at HSBC would earn 5% interest per year, (or $450 Billion per year).

G. That $450 Billion earned interest per year would be taxed unless it was paid directly into a non-taxable trust account.

H. That $450 Billion would be paid to the redeemer on a monthly basis (or $37 Billion, $500 million every 30 days).

I. On a payout extending over 25 years the redeemer would receive both their principle of $120 Billion per year, plus $450 Billion in earned interest per year (or a total of $570 Billion per year).

J. At the end of that 25 years the redeemer could be paid the $9 Trillion left at HSBC, or could choose to leave it at HSBC for another 5 years and continue to collect interest on their $9 Trillion, (and do so again at 5 year intervals thereafter).

K. Since the redeemer has all ready paid 80% of their exchange to Zimbabwe charities, they did not have to dedicate any more of their monies to humanitarian work. (Although, it makes no sense not to help others if you have the resources).

L. Redeemers do, however, have to pay tax on their earned interest unless it is paid directly into non taxable trust accounts - which could be used for humanitarian projects.

M. If you know the amount of money needed to fund your humanitarian projects it was suggested that you determine how much monies you would receive by taking the Zim screen rate. If that amount was not enough to fund your projects, you might want to consider asking for a higher contract rate. It has been said you will receive what you ask for, providing you can justify that amount of money was needed for humanitarian work.

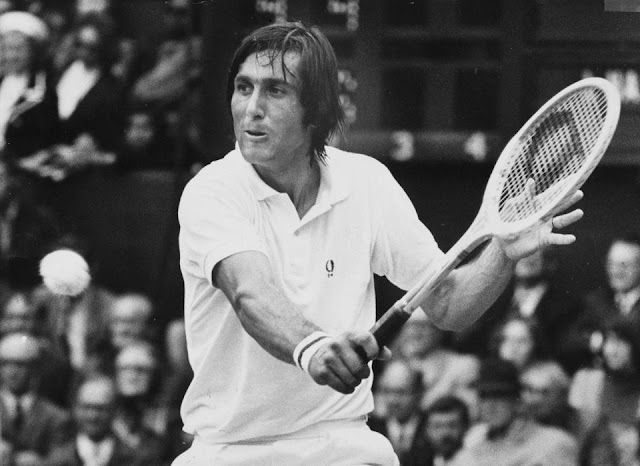

B. Sept. 9 2017 1:34 am EDT GCR Intel Situation Report: "Ilie Nastase" - GCR/RV Intel SITREP - Saturday - September 9, 2017

1. What if all the 2008-09 AA, AB, AC series Zimbabwe currency was both gold and diamond backed before it was ever printed? That would mean... wait... it was always asset backed and never was not collateralized?

2. If true, that would also mean all western banks and governments, media outlets, IMF, WB, BIS, Fed and ECB bankers lied to the world about Great Zimbabwe's wealth dating back to the days of Cecil Rhodes?

3. Thursday's update was on point and confirmed via separate sources including the table. http://inteldinarchronicles.blogspot.com/2017/09/the-big-call-w-bruce-intel-only-replay.html?m=1

C. Sept. 9 2017 7:50 pm EDT GCR Intel Situation Report: "Greek Tragedy" - GCR/RV Intel SITREP - Saturday - September 9, 2017

Thanks to:http://inteldinarchronicles.blogspot.com

Sat Mar 23, 2024 11:33 pm by globalturbo

Sat Mar 23, 2024 11:33 pm by globalturbo

The same cabal who did 9/11 (16 years ago) attacked NY & the Pentagon are doing this again in an attempt to stop / delay the RV/GCR and announcements of NESARA / GESARA using fake hurricanes.

The same cabal who did 9/11 (16 years ago) attacked NY & the Pentagon are doing this again in an attempt to stop / delay the RV/GCR and announcements of NESARA / GESARA using fake hurricanes.